Past Performance & 2024 Newsletters

Looking Back to See Ahead: Lessons From Our 2024 Newsletters

When we revisit the newsletters sent to clients throughout 2024, a consistent theme emerges: caution in the face of historic market performance. At the time, we emphasized three critical points:

- The historical rarity of back-to-back years delivering +20% returns in the S&P 500.

- The growing probability of a meaningful market pullback.

- The importance of preparing for a transition from a “risk-on” portfolio posture to a more defensive “risk-off” stance.

Q3 2024 Client Newsletter: Stock Market Update & Economic Outlook

Going into the third quarter of 2024, four primary data points shaped my market view:

- The interest rate environment and its trajectory.

- The U.S. Presidential election cycle and associated policy risk.

- The previous two years of S&P 500 performance, both delivering unusually strong returns.

- U.S. labor market data as a leading indicator of economic resilience or weakness.

Special attention was given to studying prior market cycles—especially those leading into past recessions—where early warning signs were often ignored until well after market momentum shifted.

At the time, my stance was clear:

“I would rather be wrong for all my clients by missing out on a few more percentage points of upside—say +6% or +7%—while still having locked in exceptional gains, than be wrong about the market being ready for another sustained rally and end up riding a drawdown of -15% to -30%.”

The message was not about pessimism—it was about protecting capital after a period of outsized gains and positioning for asymmetric opportunities should markets reprice risk.

We also discussed a conditional shift from a risk-on to a risk-off allocation depending on evolving economic indicators. This was particularly relevant heading into Q4 2024, with some client accounts posting year-to-date gains exceeding +50%. The calculus was straightforward: preserving those returns was, in itself, a competitive advantage.

🧵Q3 Client Newsletter: Stock Market Update & Economic Outlook:

— The Grosvenor Perception (@TGPerception) June 8, 2025

Original Date - Thursday, Oct 24, 2024

This is a free link to one of my client newsletters for anyone to read.

🎯I stressed the potential of a -15 to -30% market correction.https://t.co/e4ppTnNaj1

Q4 Quarterly Market & Economic Newsletter – December 29, 2024

By year-end, the following four factors dominated our market outlook:

- The exceptionally rare +30% annual return in the S&P 500.

- The state of market volatility, as measured by the VIX.

- The Federal Reserve’s “higher for longer” interest rate stance.

- Elevated investor sentiment, bordering on greed and euphoria.

My guidance was framed around scenarios:

“My prediction, for now, is that we will see markets continue to go risk-off throughout the early part of the new year. If we get initial policy changes with significant market implications, we will reassess portfolio positioning.”

For more balanced outcomes, we considered a “middle of the road” year—one defined by substantial swings but modest single-digit annual returns. In that environment, portfolio construction would emphasize tactical positioning to exploit volatility, rather than simply riding market beta.

🧵Q4 Client Newsletter: Stock Market Update & Economic Outlook:

— The Grosvenor Perception (@TGPerception) June 8, 2025

Original Date - Sunday, Dec 29th, 2024

This is a free link to one of my client newsletters for anyone to read.

🎯My prediction of the markets going Risk-Off through the start of the year.https://t.co/dpk20Ct4FC

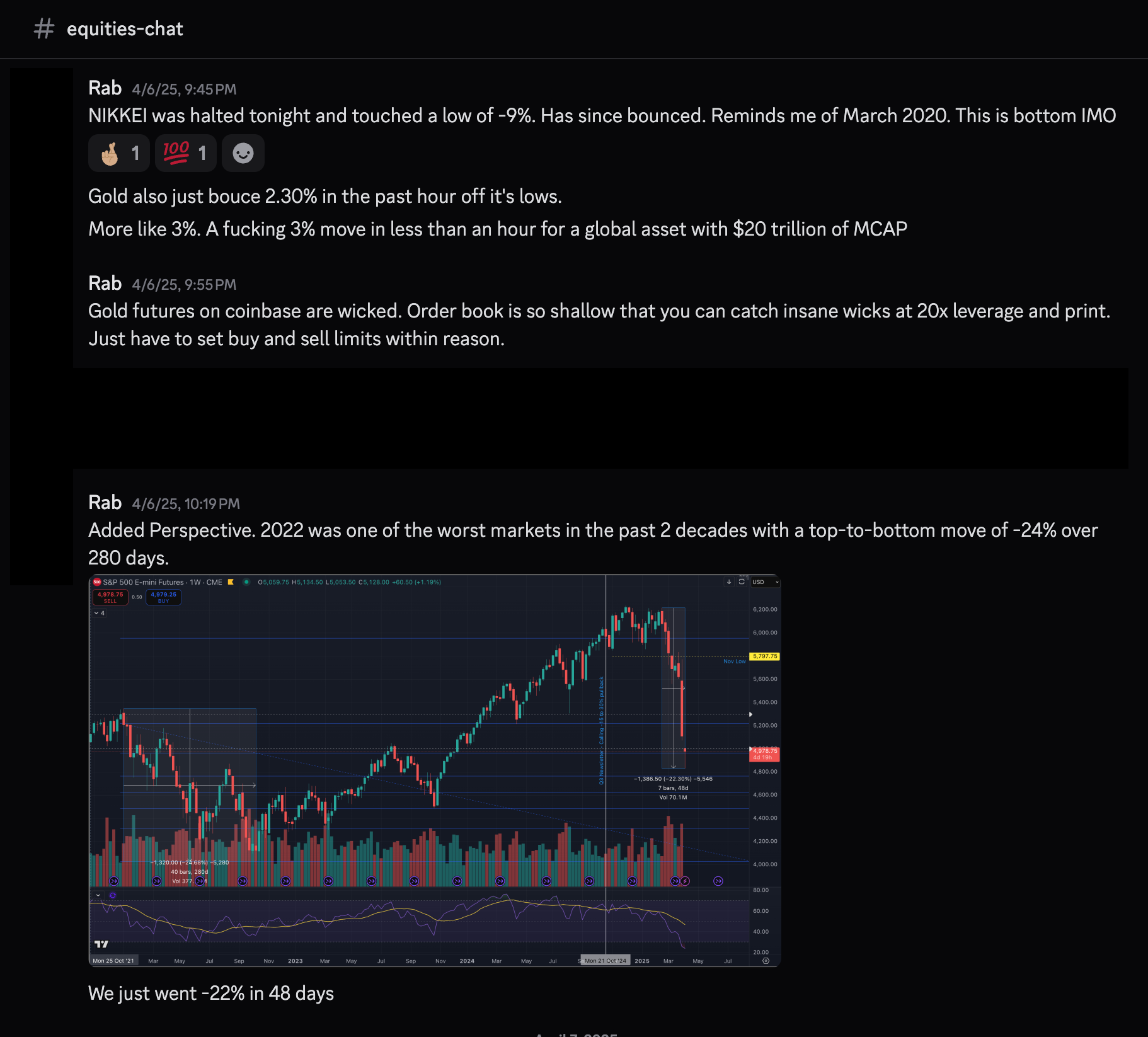

April 2025 Market Crash – A Bottom Called with Precision

The April selloff became one of the most attractive buying opportunities of the past decade. It presented a rare moment when almost every category of investor—retail, institutional, and global—could add to or initiate positions across a wide spectrum of assets.

From the open on Monday, April 7, 2025, the S&P 500 rallied +28.98%. For perspective, since 1926, the index has only posted an annualized return greater than +28% 21 times. What made this surge remarkable was the speed: it took just 123 days to deliver what has historically been considered a full year’s extraordinary performance.

Key Takeaways

- Historic Returns Breed Complacency – Periods following extreme market gains often invite overconfidence and underpricing of risk.

- Volatility Creates Opportunity – Well-timed tactical shifts can capture asymmetric upside without exposing portfolios to unnecessary drawdowns.

- Macro Still Rules – Interest rates, election cycles, and global policy shifts remain the primary forces shaping long-term return paths.

Our philosophy has remained consistent: capture gains when available, protect capital during periods of uncertainty, and position decisively when markets mis-price assets.

Disclosure Statement for The Grosvenor Perception

Last Updated: 08/02/25

General Disclaimer

The Grosvenor Perception (“we,” “our,” or “the publication”) is a financial newsletter published by Michael Harbin. All content published in this newsletter, whether online, in email, or through any affiliated platforms, is intended for informational and educational purposes only. None of the information contained herein constitutes investment, financial, legal, or tax advice.

The views expressed in The Grosvenor Perception represent the personal opinions and analysis of the writers and contributors as of the date published and are subject to change at any time without notice. These opinions do not reflect the views of any affiliated institutions, employers, or entities.

No Investment Advice or Recommendations

The Grosvenor Perception is not a registered investment advisor, broker-dealer, or financial planner. We are not licensed under the U.S. Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or any other regulatory agency in any jurisdiction to provide personalized financial advice or investment recommendations.

Nothing published in this newsletter or on our website should be construed as a solicitation, offer, or recommendation to buy, sell, or hold any security or financial instrument. Subscribers and readers are solely responsible for their own investment decisions and should consult a licensed financial advisor, tax professional, or legal advisor before making any financial or investment decisions.

No Guarantee of Results or Performance

While we strive to provide accurate and up-to-date information, The Grosvenor Perception does not guarantee the accuracy, completeness, timeliness, or reliability of any information contained in our content. Financial markets are inherently uncertain and subject to numerous variables; past performance is not indicative of future results.

We disclaim all liability for any errors, omissions, or inaccuracies in the information presented. We make no representations or warranties—express or implied—regarding the effectiveness or profitability of any strategy, investment, or analysis discussed.

Forward-Looking Statements and Speculative Content

Some content in The Grosvenor Perception may contain forward-looking statements, projections, or speculative commentary, which are inherently uncertain and involve risks. These statements reflect our best judgment and interpretation at the time of publication but may not materialize as anticipated due to factors beyond our control.

Conflicts of Interest and Compensation

Writers and contributors to The Grosvenor Perception may have personal investments in securities or assets mentioned in the publication. Any such positions are not intended as recommendations and may be disclosed at the discretion of the author.

The newsletter may also contain sponsored content or affiliate links for which we may receive compensation. Any such material will be clearly marked in accordance with applicable FTC guidelines.

Copyright and Distribution

All content published in The Grosvenor Perception, including text, images, logos, and branding, is the intellectual property of Michael Harbin and is protected under applicable copyright laws. Unauthorized reproduction, redistribution, or public display of any portion of our content without written permission is strictly prohibited.

Jurisdiction and Legal Compliance

This publication is intended for a U.S.-based audience and is governed by the laws of the State of Florida, without regard to its conflict of laws principles. Access to the content of The Grosvenor Perception may not be legal for individuals in certain jurisdictions. It is the responsibility of the reader to ensure compliance with their local laws and regulations.

Contact Information

If you have questions about this disclosure or wish to contact the publisher of The Grosvenor Perception, please reach out to:

The Grosvenor Perception

admin@grosvenorperception.com

By reading this newsletter or accessing our content, you acknowledge that you have read, understood, and agreed to the terms outlined in this disclosure.

Member discussion