Stock Market Update & Economic Outlook - Issue No. 1

2025 has been a year of dramatic swings thus far across many asset classes. We’ve experienced an historic drawdown and recovery in the equities market, a bond market that is on the brink of collapse, and inflation hedge assets such as Gold and Bitcoin that have outperformed due to the high levels of uncertainty.

The introduction of tariffs from the Trump administration have created enormous amounts of fear for many US companies creating the need to restructure financial outlooks and forward guidance.

The S&P 500 has posted a YTD return of only 6.30% (at the time of writing) with a max drawdown of -18.10%. Tech stocks have underperformed the broader market and experienced a max drawdown of -23.81%. The Mag 7 has contributed to over 50% of the overall market cap recovery since the lows on April 7th. S&P 500 in May had the strongest monthly performance since 1990. Although the market conditions have been very tough through the first half of the year, they have also created an immense amount of opportunity for those ignoring the noise and focusing on the proper perspective.

Where do we go from here? Into the end of 2025.

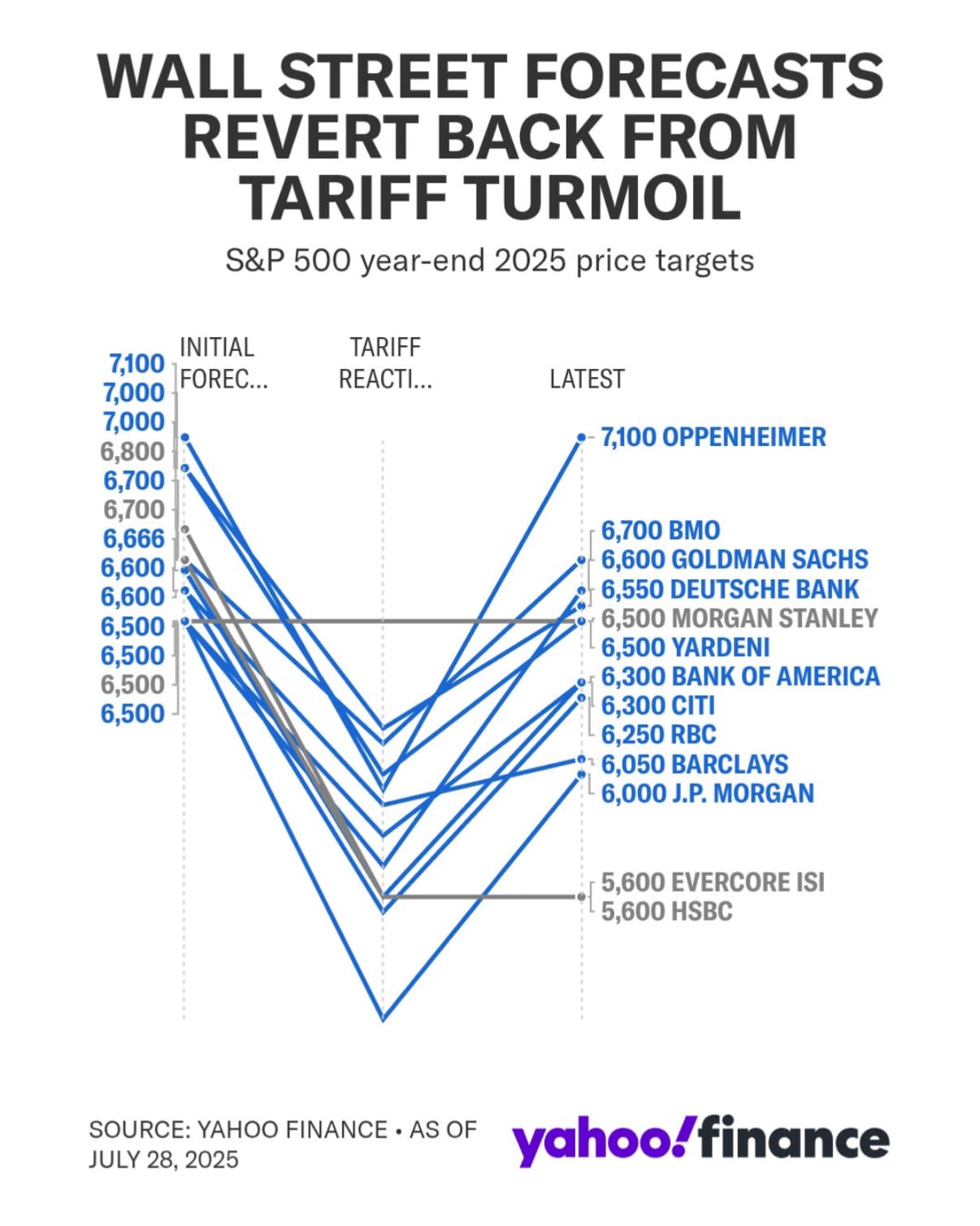

Beginning with the end in mind has been completely missed through the first 5 months of the year. If the S&P 500 were to end at either end of the initial forecast spectrum, the returns will have to range from a minimum of +6.67% to a maximum of +18.33% from current level.

Given the economic contraction we’ve felt, 7100 seems completely out of consideration. The S&P would have to average +2.61% per month for the rest of the year to hit.

Prediction markets have the chance of a recession at 26%, down from 70% a month ago. The biggest worry that we have is the state of the real estate market and what a continued stall in interest rate reductions could do recession odds. Real estate is the heart of our economy and the prolonged squeeze consumers have experienced has expanded household debt and defaults. Along with 50% of Small Caps remaining unprofitable, the overall health of the economy isn’t positioned for a strong Risk-On environment. There seems to be a political bias to the interest rate reduction with the white house pressuring the Fed to cut rates immediately and half of the Fed wanting to keep rates elevated with the anticipation that tariffs will drastically re-ignite inflation.

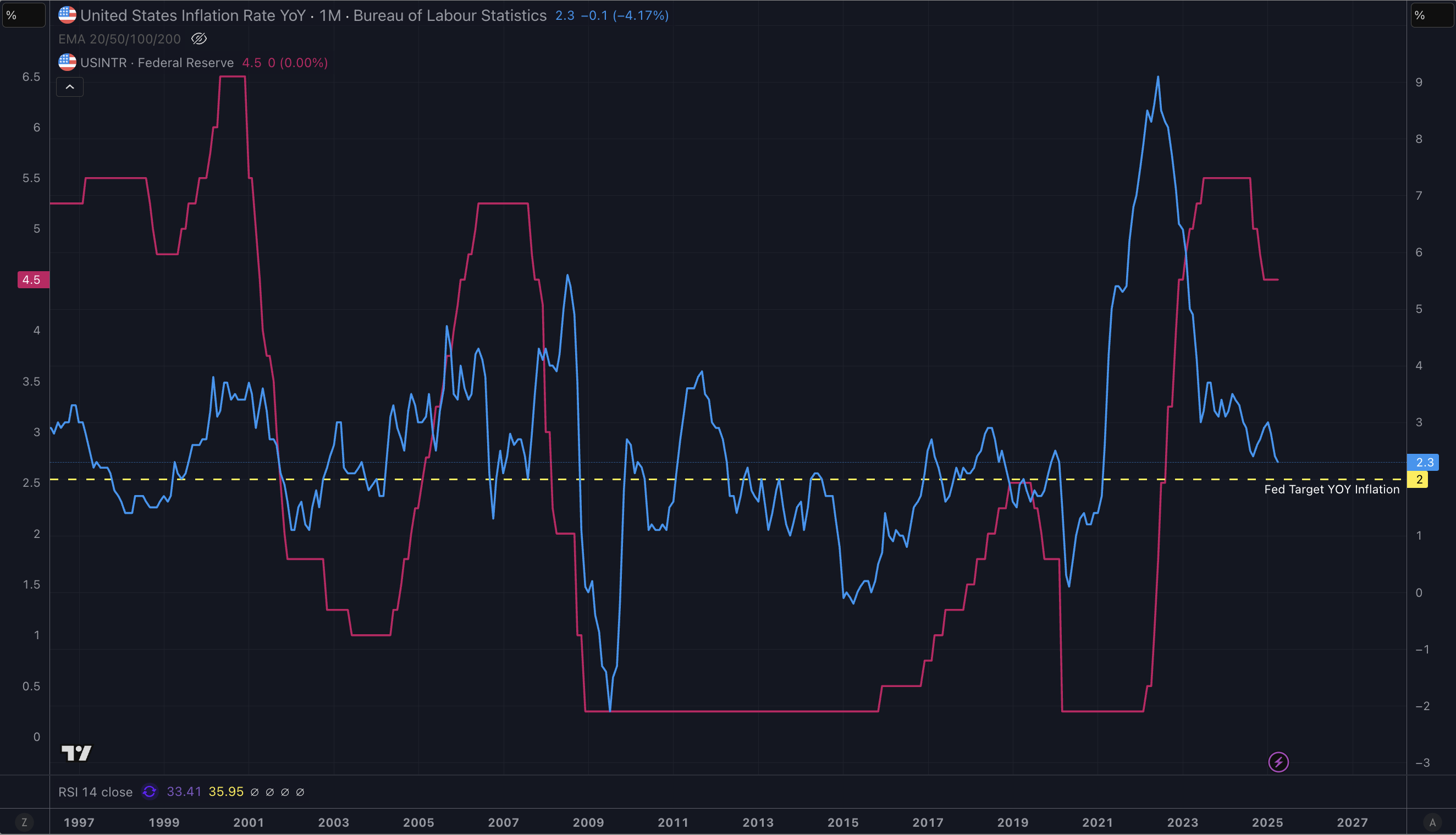

After YOY Inflation peaked in June 2022, the Fed continued to raise rates over the next 13 months. At the end of the rate hike cycle, YOY inflation had already reduced from the high of 9.1% down to 3.2%. As of April, YOY inflation is sitting at 2.3% which is lower than pre-covid lockdown YOY inflation.

The chart above shows YOY inflation rate with the interest rate overlaid. If we evaluate the previous rate cut cycles, a larger cut seems like it should come sooner rather than later. Especially given the diluted value of the US Dollar’s purchasing power over the last decade.

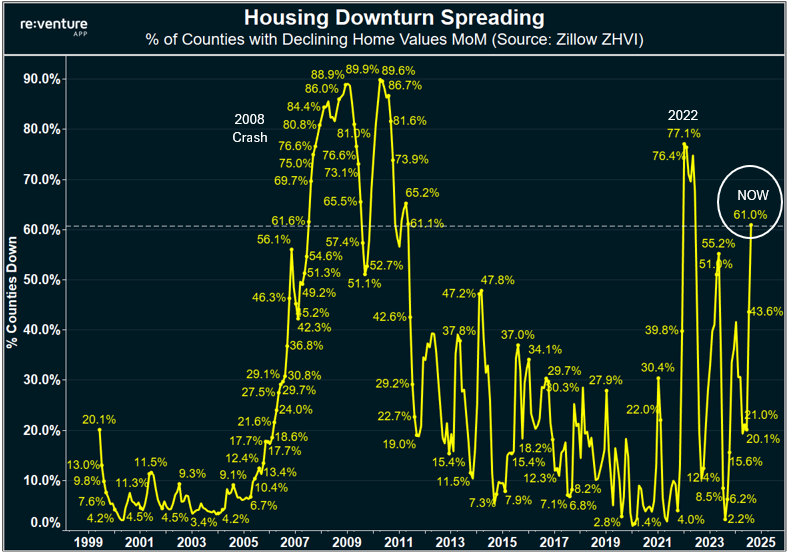

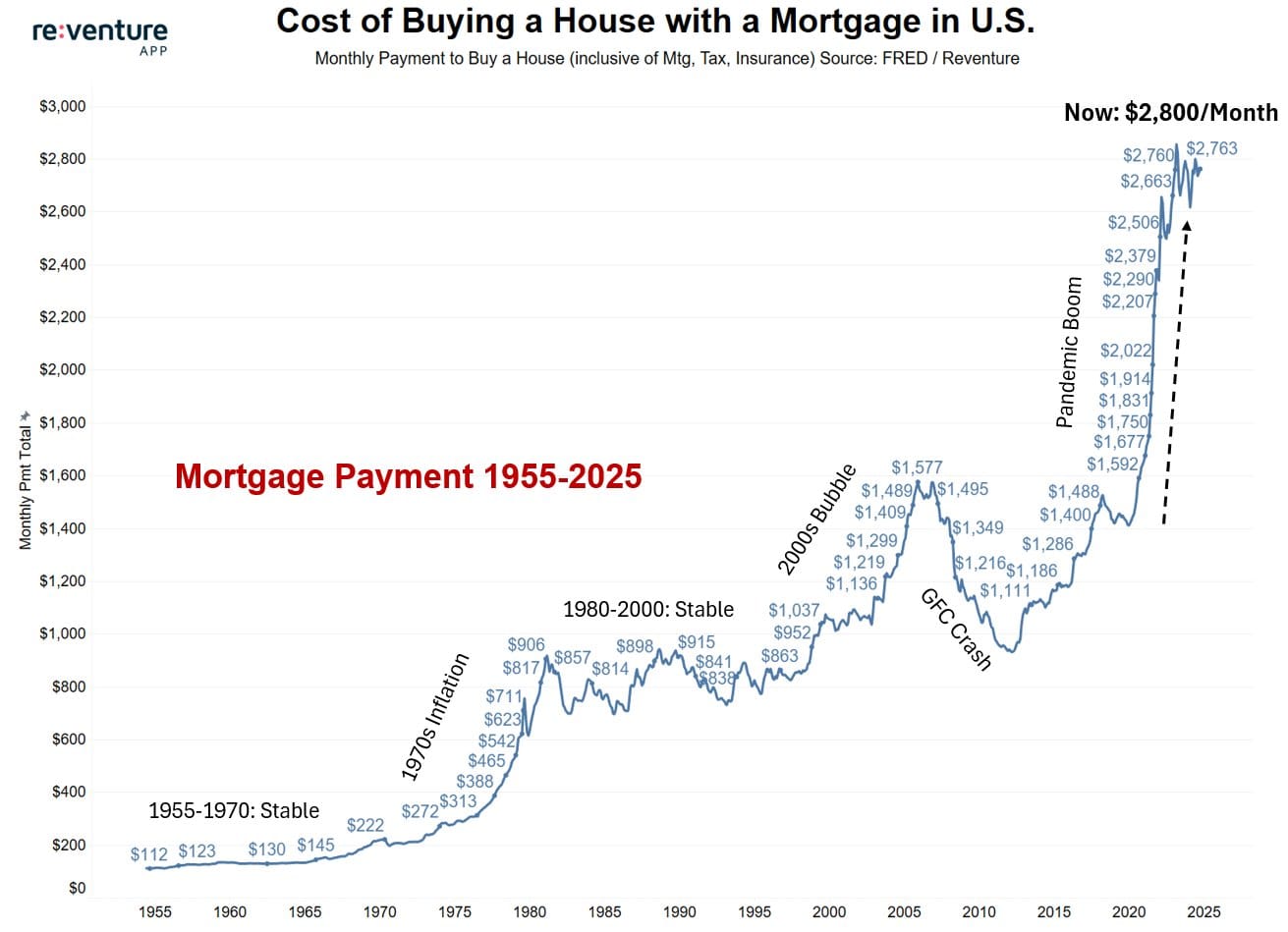

To expand on our concerns around the real estate market and how it might cause drastic impacts across other markets, let's look at a few metrics that show the deteriorating real estate environment. One metric that stands out is the percentage of US counties that are experiencing a decline in home values Month-over-Month.

When compared to the last cycles of the same decline, we can see that the drop in fed funds rate post-covid led to the extreme YOY hike in inflation which led to housing prices to drastically decline MOM. The other similar MOM decline in value was during the great recession of 07’ & o8’ in which the real estate market was destroyed. Take a look at the chart below:

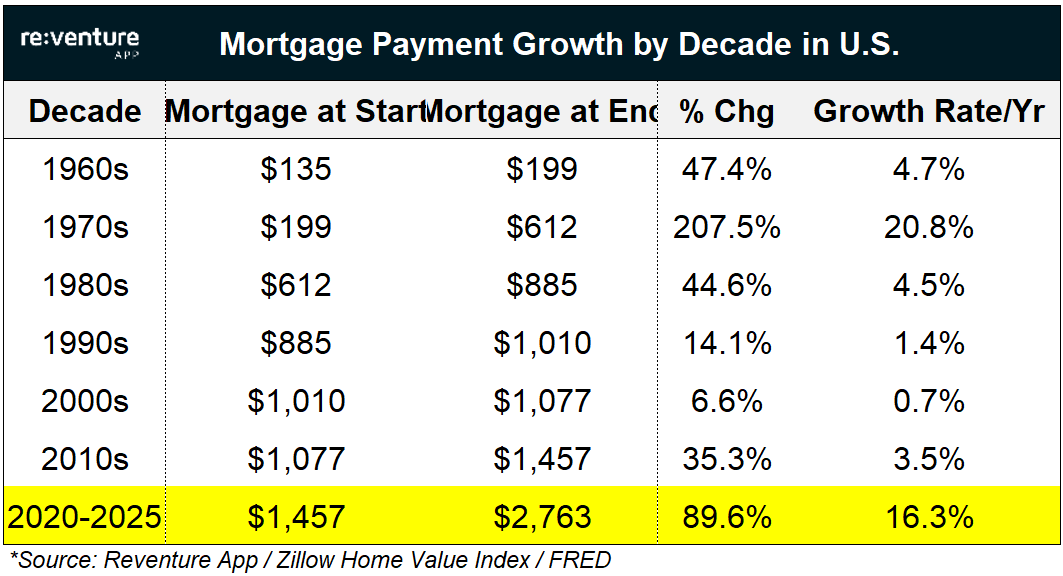

When we take the diluted value of the US dollar into perspective we can see that it has created an almost unaffordable mortgage environment. From 2020 to 2025 mortgages have almost doubled, increasing by 89%. From a historical standpoint, this type of home cost can be sustained and needs to level-out.

All of this also echoes the importance of compounding investment growth. Especially if wage growth is growing at a steady pace. The 2020 to 2025 mortgage increase equates to a YOY growth rate of 16.3%. Compared to the average annual S&P 500 return of 10.52% the impact of mortgage rate growth has obliterated the average American's ability to afford living within comfortable means. This has removed the ability to save and continue putting money aside for investment portfolios.

If you aren’t able to keep up with the rising cost-of-living on top of the steady rise of inflation, as time goes on your ability to provide for the same level of living will eventually turn negative. On a grand scale, this would lead the majority of Americans to over leverage with debt and potentially lead to a debt crisis.

We want to empower our subscribers to not only keep pace with the rising cost of living, but create the opportunity to outperform the S&P 500 and also outpace the external rising cost that is out of our control.

US Conflicts and Concerns

The internal political climate of the United States continues to intensify, with mounting activism on both ends of the ideological spectrum. This polarization appears to be advancing steadily—like a slow-moving escalator—with each passing month. In the opening six months of President Trump’s second term, the administration has enacted several aggressive policy shifts, sparking widespread protests over a number of contentious issues.

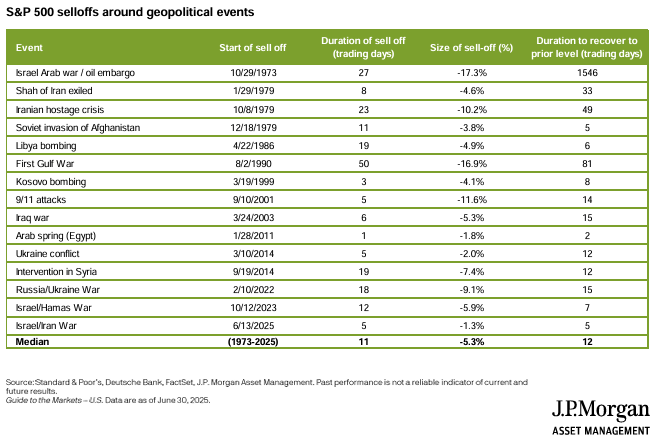

Among the most pressing concerns is the escalating conflict in the Middle East. In our view, the war between Israel and Iran has the potential to significantly destabilize global geopolitics. Beyond regional implications, we believe this conflict could act as a flashpoint that further deepens the divide between Western allies and the BRICS nations, particularly China and Russia. These developments are not occurring in a vacuum—they are unfolding against the backdrop of a rapidly evolving global trade environment.

One of the most consequential policy shifts initiated by the Trump administration is the implementation of sweeping tariffs. This new protectionist posture represents uncharted territory—not only for the United States but also for the global economy, as affected nations are now responding with reciprocal measures. While critics of the administration have forecasted these tariffs as a harbinger of surging inflation, we maintain a different perspective.

In our assessment, these tariffs should be viewed as a long-term strategic maneuver. Rather than triggering immediate inflationary pressures, we believe they represent a calculated effort to address structural imbalances—namely, the expanding federal deficit and the unchecked growth of the money supply. If effective, this approach could initiate a mild deflationary trend that would support the strengthening of the U.S. dollar and, in turn, improve the purchasing power of American consumers.

However, this strategy is not without risk. The most existential economic threat facing the United States remains the potential loss of the U.S. dollar’s status as the global reserve currency. Should the dollar falter, the Chinese yuan—backed by the world’s second-largest economy—would be the most likely successor. While it may be tempting to assume that economic pragmatism will foster cooperation between China and the United States, the geopolitical incentives suggest otherwise. It is not in Beijing’s strategic interest to enable policies that enhance U.S. economic dominance, particularly in light of escalating tariff pressures.

China’s long-standing campaign to influence U.S. policy and weaken the ideological foundations of Western liberal democracy is no longer covert. Through state-directed efforts, the Chinese Communist Party (CCP) continues to exploit digital platforms, mainstream media, and gray-zone operations that resemble the very covert tactics pioneered by Western intelligence agencies such as the CIA during the Cold War era.

All of this geopolitical tension and economic realignment brings us to a critical investment thesis—one that we believe holds significant promise both in the near term and over the next decade.

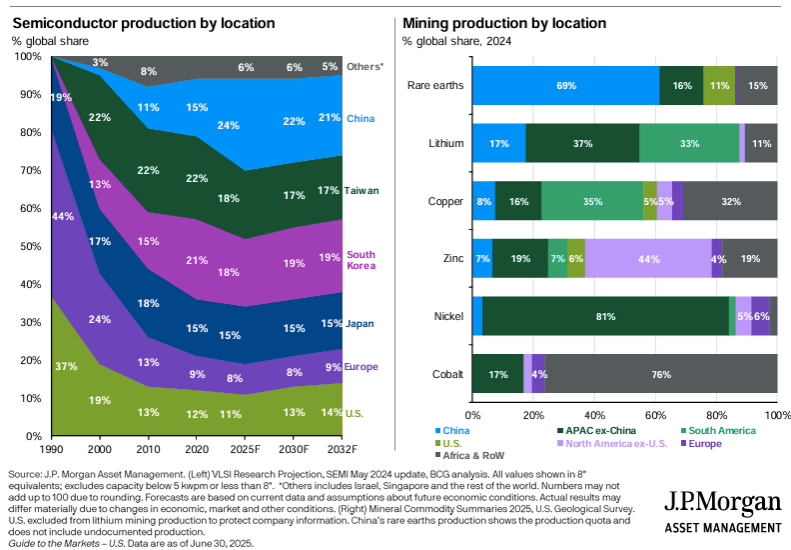

As U.S.-China trade tensions escalate and global supply chains fracture along political lines, we are placing a heightened focus on rare earth minerals—strategic resources vital to the technologies that will define the next era of global competition. These materials are indispensable to the production of advanced semiconductors, batteries, military hardware, and most notably, the infrastructure supporting artificial intelligence.

The exponential growth of AI-related technologies, particularly in the development of hyper scale data centers and enterprise machine learning applications, has clarified where capital and innovation are flowing. Demand for compute power is surging, and the materials that underpin this revolution—rare earths, high-performance chips, energy-efficient cooling systems—are rapidly becoming the new oil.

We see this convergence of geopolitical risk and technological acceleration as a prime window to allocate risk. Our conviction is rooted in both the macro-level strategic realignment of global power structures and the micro-level supply-demand dynamics of emerging technologies.

Rare Earth Minerals

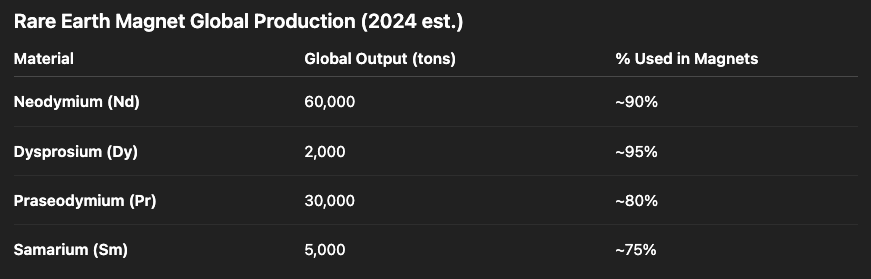

Magnets, particularly rare-earth magnets, play a crucial and often under appreciated role in the physical infrastructure behind high-performance computing (HPC) and artificial intelligence (AI).

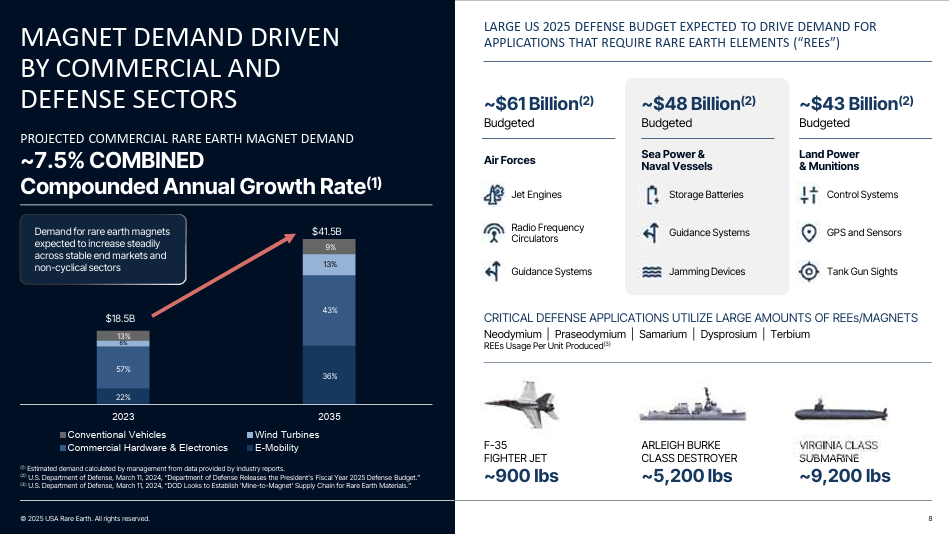

- Global permanent magnet market: $23.4B (2024)

- Projected growth rate: 7.5% CAGR, reaching $36B+ by 2030

- Magnets for AI-related infrastructure (est.): Account for ~15–20% of global high-performance magnet demand in 2024

Their contribution spans from powering electric components to enabling the motion systems of advanced cooling solutions and robotic automation systems in data centers. Let’s break down their value, role in AI infrastructure, key metrics, and supply chain dynamics.

AI hardware, especially GPUs, needs constant innovation in thermal management, power efficiency, and electromechanical support systems—all of which use magnets.

- NVIDIA H100/A100 Cooling Fans - Each uses 2–3 brushless DC motors, each requiring high-strength rare-earth magnets

- Server Power Supply Units (PSUs) - Use magnetic cores to manage power conversion with minimal loss

- Actuators in AI robotics - High-torque, compact, magnet-powered motors for fine control

*A single hyper scale data center may use over 100,000 fans and motors, each using magnets.

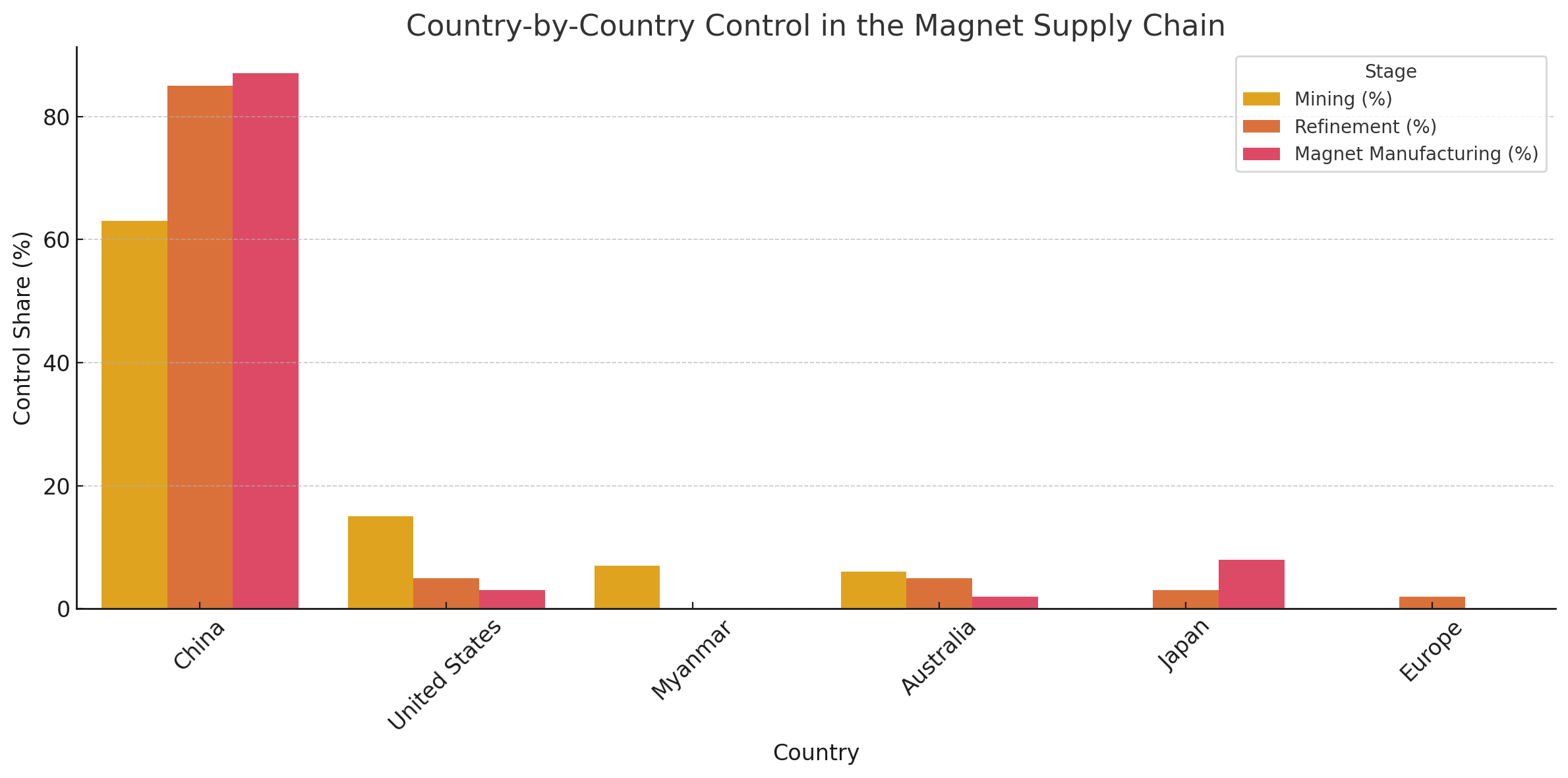

China controls over 85% of magnet-grade rare-earth separation and processing. U.S. firms like MP Materials (Mountain Pass, CA) extract neodymium but still send material to China for processing.

- China 87% - of global sintered NdFeB magnet production

- Japan 8% - (high-tech applications)

- U.S. & Europe - <5%, mostly for defense contracts

Take a look at this plot showing the vast imbalance in the global magnet supply chain.

AI hardware is geopolitically exposed to rare earth magnet supply chains. The U.S. is actively trying to onshore magnet production (e.g., Lynas, MP Materials downstream projects). Without magnets, there is no efficient cooling, no power management, and no motion systems for AI hardware. Magnets directly enable high-density GPU farms that power LLMs, autonomous systems, and inference engines. They are non-substitutable for many precision AI applications due to their magnetic strength-to-weight ratio. The future of AI at scale will increasingly hinge on a stable and secure magnet supply chain.