September Market Outlook

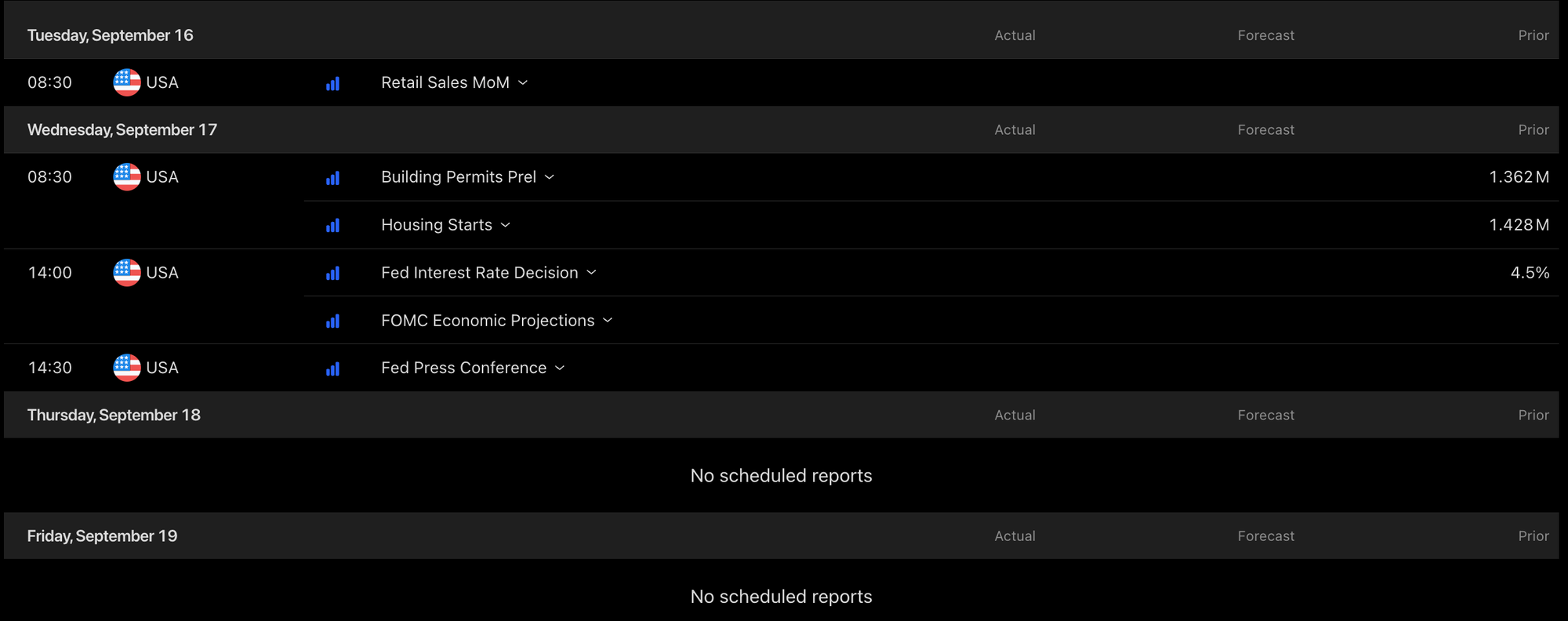

Markets are currently pricing in a 92% probability of a 25bps rate cut at the upcoming September 17th FOMC meeting. So far this month, we’ve seen moderate volatility across asset classes, though the S&P 500 remains essentially flat month-to-date. The standout performer has been gold, which continues to play its role as an uncertainty hedge. On Friday, gold closed at $3,653.30 per ounce, putting its MTD return near +3% and setting yet another all-time high.

The VIX remains subdued, hovering around the 15 level, while the CBOE Put/Call ratio settled at 0.644, reflecting a still-bullish sentiment backdrop. Meanwhile, the rotation narrative we’ve been tracking, capital flowing from mega-cap tech into smaller names, has gained traction. Small caps have begun to materially outperform both the S&P 500 and the value index. On Friday, September 5th, the S&P 500 notched a fresh all-time high intraday but quickly reversed, finishing slightly in the red signaling market hesitancy at elevated levels.

Our stance remains risk-on, supported by gains in equities and gold. However, we are refraining from initiating new positions until after the September meeting. The Fed’s decision will almost certainly inject a new wave of volatility, and patience here provides an edge.

One of the most valuable principles in trading and investing is discipline through patience. At times like this, when sentiment is fragmented and noise dominates, investors often risk reacting emotionally. Overtrading into short-term commotion tends to erode returns and undermine strategy.

A trade we have been waiting on for over a year is the small-cap trade tied to falling interest rates. Roughly 40% of small-cap companies remain unprofitable under elevated financing costs. Rate reductions could improve balance sheets, lower debt servicing costs, and open the door to stronger forward guidance. When that shift comes, small caps could benefit disproportionately.

The biggest curveball remains the ongoing impact of tariffs. Over the past two years, tariffs have distorted input costs, creating sector-specific winners and losers. This has reinforced a “stock-picker’s market,” where active managers have significantly outperformed passive index exposure.

But as we look forward, we believe this trend may reverse or become less profitable. Equity markets are no longer trending as strongly as they did off the April lows, and uncertainty remains elevated. Under these conditions, we expect index exposure to provide greater stability than concentrated stock-picking, especially as volatility risk looms.

Volatility remains the key risk factor. Any reversal in the VIX’s trend could have a sharp downside effect on portfolios. Recall that during the July FOMC meeting, when the Fed held rates steady, markets reacted negatively despite a week of heavy economic data. The VIX spiked to 21.90, and the S&P 500 shed 2.36% in just two trading days.

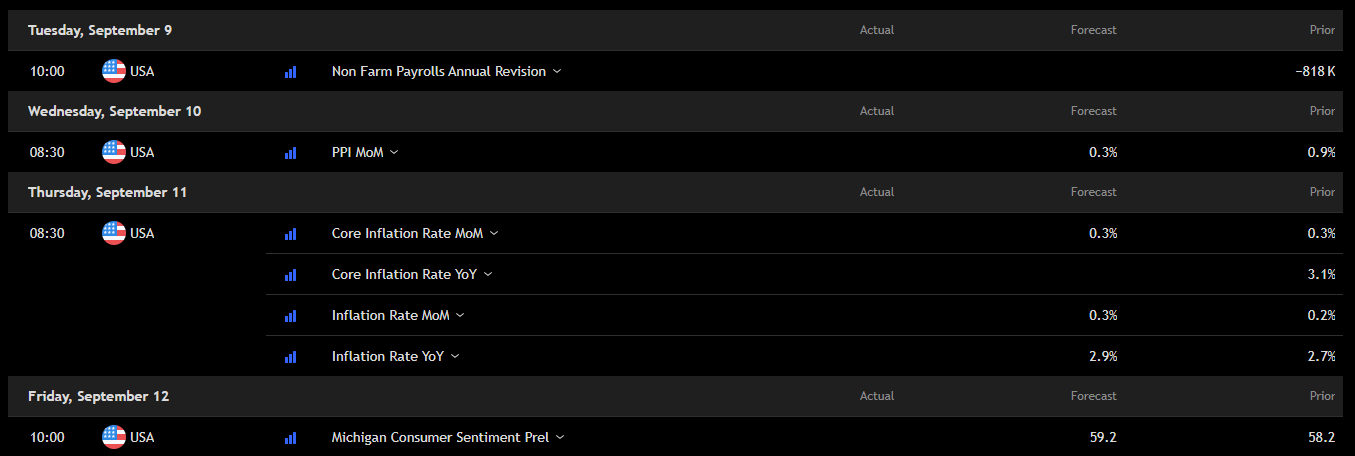

With a full slate of economic data releases scheduled for the week of September 8th–12th, we could see another setup where sentiment shifts sharply ahead of the Fed decision.

Markets are walking a fine line between optimism and caution. With gold confirming uncertainty, small caps showing renewed life, and volatility measures deceptively calm, we believe patience is the winning trade until the Fed provides clarity on September 17th.

If you’d like to take a deeper dive and see the specific positions we’re updating in our premium tiers, click the link below to upgrade your subscription today👇

Disclosure Statement for The Grosvenor Perception

Last Updated: 08/02/25

General Disclaimer

The Grosvenor Perception (“we,” “our,” or “the publication”) is a financial newsletter published by Michael Harbin. All content published in this newsletter, whether online, in email, or through any affiliated platforms, is intended for informational and educational purposes only. None of the information contained herein constitutes investment, financial, legal, or tax advice.

The views expressed in The Grosvenor Perception represent the personal opinions and analysis of the writers and contributors as of the date published and are subject to change at any time without notice. These opinions do not reflect the views of any affiliated institutions, employers, or entities.

No Investment Advice or Recommendations

The Grosvenor Perception is not a registered investment advisor, broker-dealer, or financial planner. We are not licensed under the U.S. Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or any other regulatory agency in any jurisdiction to provide personalized financial advice or investment recommendations.

Nothing published in this newsletter or on our website should be construed as a solicitation, offer, or recommendation to buy, sell, or hold any security or financial instrument. Subscribers and readers are solely responsible for their own investment decisions and should consult a licensed financial advisor, tax professional, or legal advisor before making any financial or investment decisions.

No Guarantee of Results or Performance

While we strive to provide accurate and up-to-date information, The Grosvenor Perception does not guarantee the accuracy, completeness, timeliness, or reliability of any information contained in our content. Financial markets are inherently uncertain and subject to numerous variables; past performance is not indicative of future results.

We disclaim all liability for any errors, omissions, or inaccuracies in the information presented. We make no representations or warranties—express or implied—regarding the effectiveness or profitability of any strategy, investment, or analysis discussed.

Forward-Looking Statements and Speculative Content

Some content in The Grosvenor Perception may contain forward-looking statements, projections, or speculative commentary, which are inherently uncertain and involve risks. These statements reflect our best judgment and interpretation at the time of publication but may not materialize as anticipated due to factors beyond our control.

Conflicts of Interest and Compensation

Writers and contributors to The Grosvenor Perception may have personal investments in securities or assets mentioned in the publication. Any such positions are not intended as recommendations and may be disclosed at the discretion of the author.

The newsletter may also contain sponsored content or affiliate links for which we may receive compensation. Any such material will be clearly marked in accordance with applicable FTC guidelines.

Copyright and Distribution

All content published in The Grosvenor Perception, including text, images, logos, and branding, is the intellectual property of Michael Harbin and is protected under applicable copyright laws. Unauthorized reproduction, redistribution, or public display of any portion of our content without written permission is strictly prohibited.

Jurisdiction and Legal Compliance

This publication is intended for a U.S.-based audience and is governed by the laws of the State of Florida, without regard to its conflict of laws principles. Access to the content of The Grosvenor Perception may not be legal for individuals in certain jurisdictions. It is the responsibility of the reader to ensure compliance with their local laws and regulations.

Contact Information

If you have questions about this disclosure or wish to contact the publisher of The Grosvenor Perception, please reach out to:

The Grosvenor Perception

admin@grosvenorperception.com

By reading this newsletter or accessing our content, you acknowledge that you have read, understood, and agreed to the terms outlined in this disclosure.

Member discussion