Risk-On vs. Risk-Off: Where are we now?

Markets have been red hot through the mid-part of 2025, setting multiple new highs across a variety of asset classes. Just this past week, we saw Bitcoin surge to an all-time high of $123,000, Gold Futures climb to $3,534, and the NASDAQ push to 21,464. These are not isolated moves—they’re occurring in parallel, signaling a broad, risk-on environment across both traditional and alternative markets.

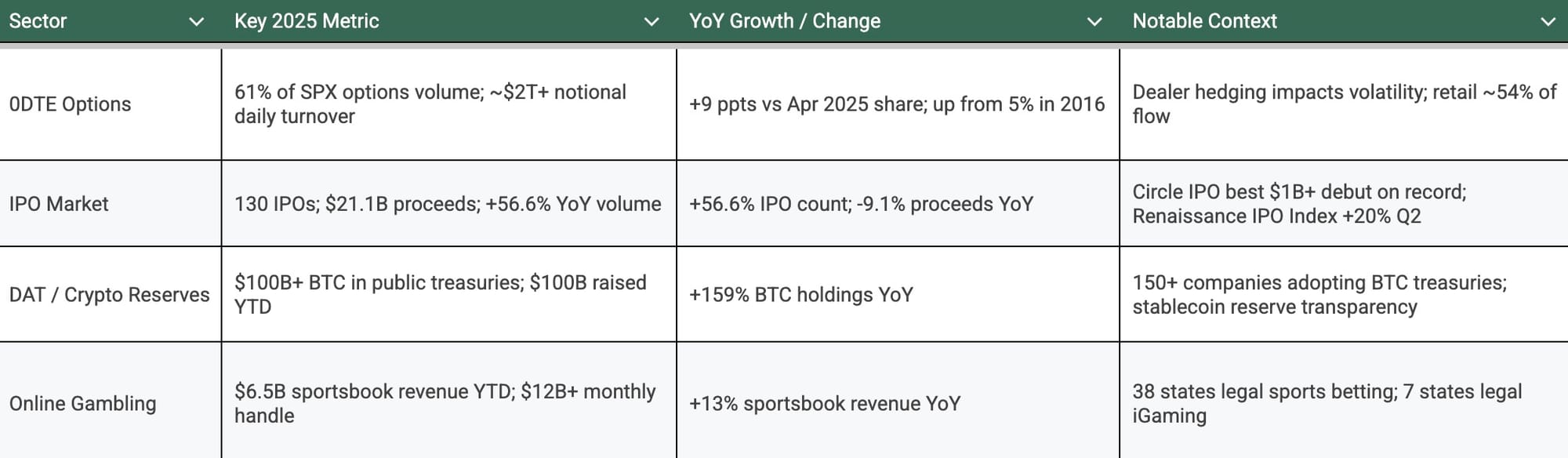

Risk appetite is arguably at its strongest point in years. We’ve seen explosive momentum in the IPO market, rapid capital inflows into newly formed Digital-Asset-Treasury (DAT) companies, and record trading volumes in Zero-Day-to-Expiration (0DTE) options. Collectively, these trends paint a picture of a market where participants, particularly retail traders,are increasingly willing to chase short-term opportunities, even if they carry elevated downside risk.

But that raises the question: why is risk appetite so high right now?

The answer isn’t just in market sentiment it’s in the economic pressures shaping that sentiment. In our view, the single largest factor pushing everyday investors toward higher-risk opportunities is the inflation cycle we’ve endured over the past five years.

Since the start of 2020, cumulative inflation in the United States has totaled roughly 24.21%, based on the Consumer Price Index for All Urban Consumers (CPI-U). In practical terms, goods and services that cost $100 in 2020 now require about $124.21 in 2025 to buy the same basket. Put another way, a dollar today buys only about 80.5 cents’ worth of what it could five years ago.

This erosion in purchasing power is more than just an abstract statistic, it’s a daily financial reality. For many households, wages have not kept pace with rising costs, meaning that to maintain the same quality of life, people either need to spend down savings or seek higher returns on invested capital. That pressure often drives capital away from conservative savings vehicles and toward speculative assets with the potential for outsized gains.

In this environment, achieving returns that merely match inflation is no longer enough. The challenge for investors is to generate ROI that not only offsets inflation’s drag but meaningfully outpaces it, creating real growth in wealth, not just a slow defense against erosion. That reality helps explain why speculative instruments, from Bitcoin to 0DTE options, are enjoying unprecedented popularity in 2025.

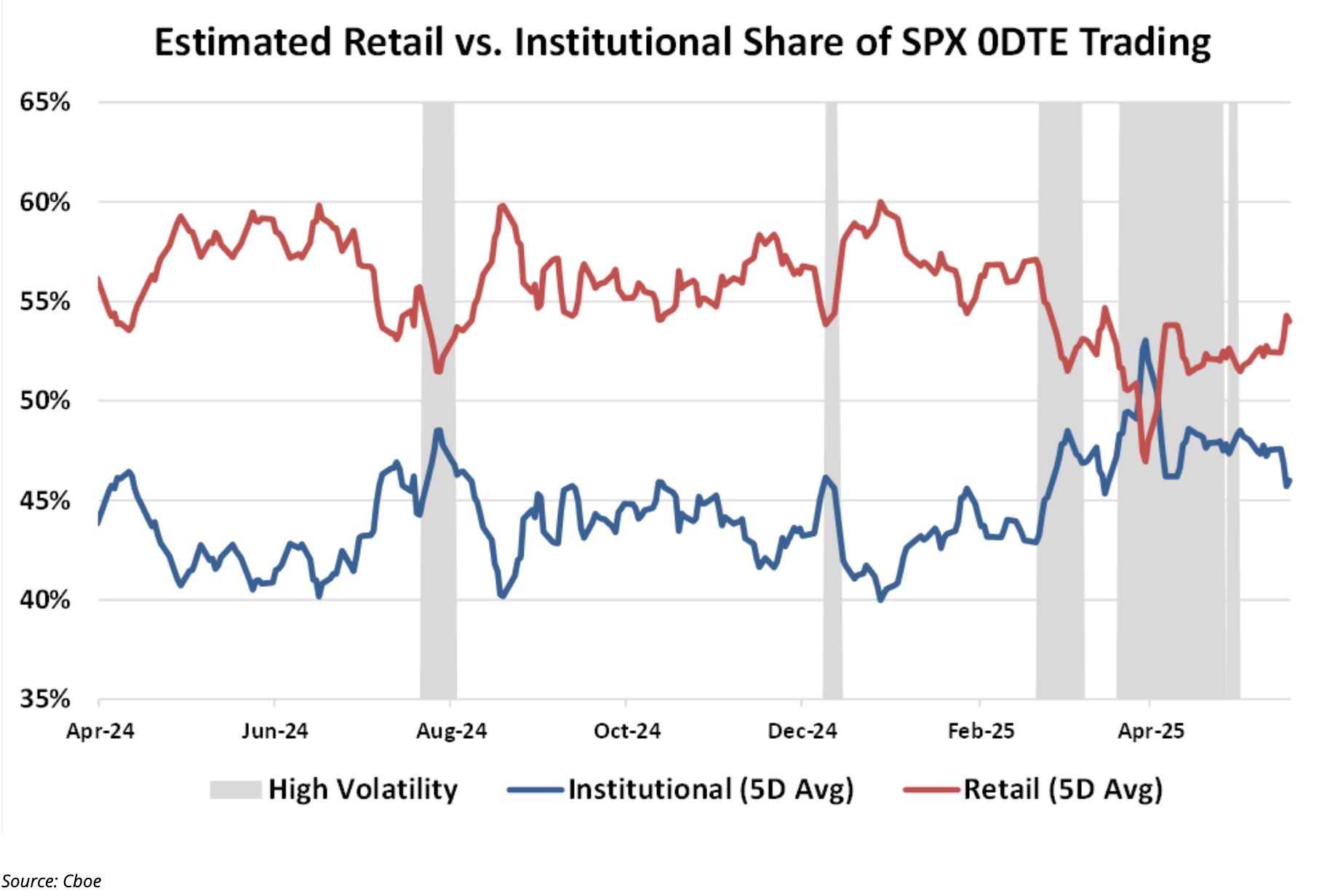

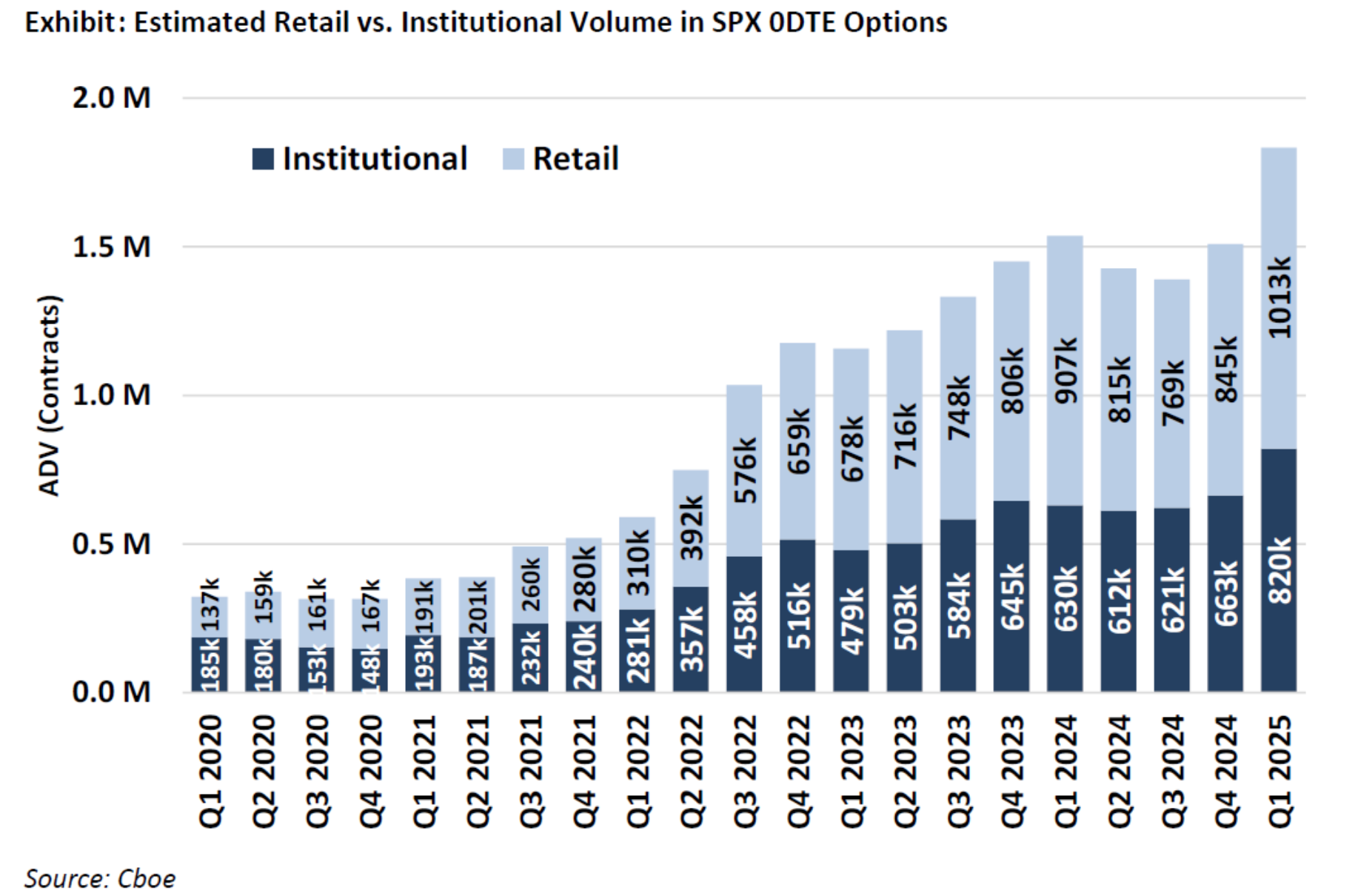

Markets are shifting fast, and some of the most interesting moves are happening outside the traditional “buy-and-hold” lanes. In the derivatives world, 0-day-to-expiry (0DTE) options have gone from niche to dominant. They now make up over 60% of SPX options volume, up from barely 5% in 2016, with daily contract turnover in the trillions of notional. Institutions and retail traders alike are leaning into the ultra-short-term leverage, with research showing both dampening and amplifying effects on intraday volatility depending on dealer positioning. It’s a corner of the market that’s redefining how liquidity, gamma risk, and event-day speculation play out in real time.

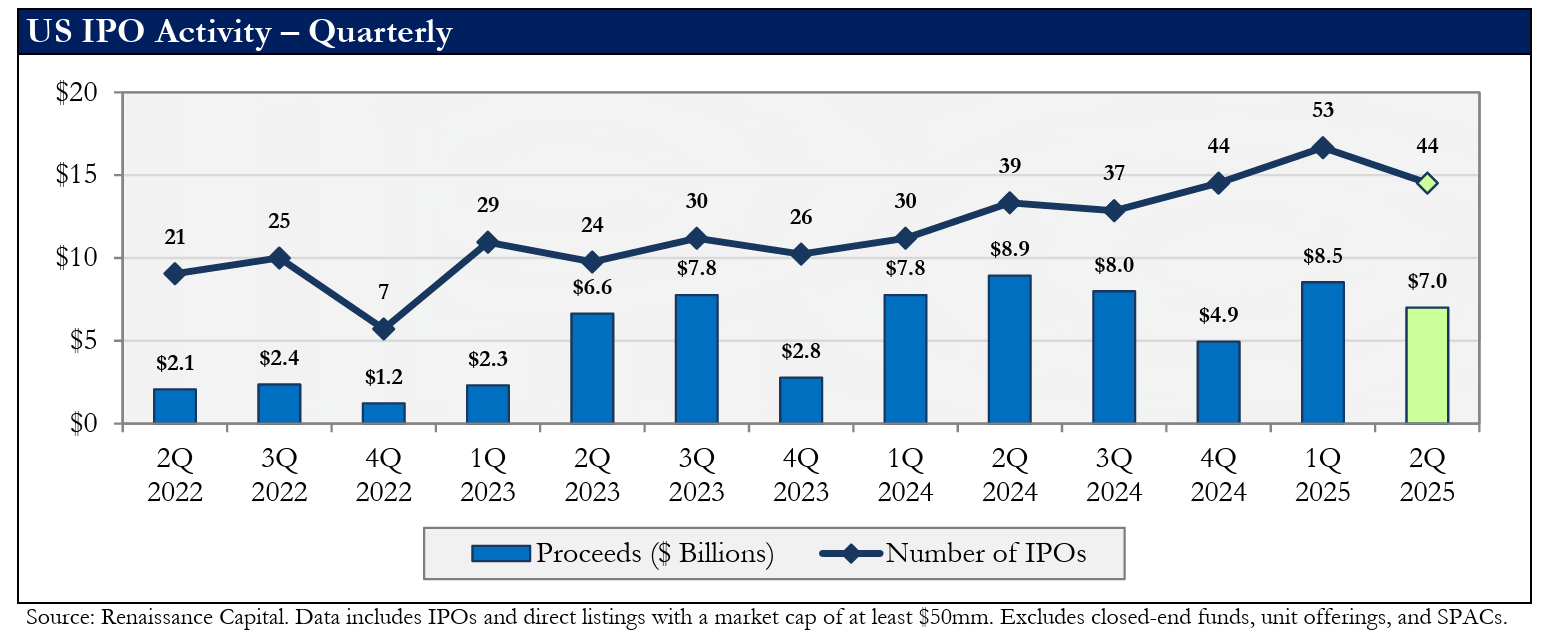

On the equity side, the IPO market has come back to life after the post-2021 drought. The U.S. has already priced 130 IPOs this year, raising over $21 billion, and global activity is tracking its strongest pace since before the rate-hike cycle began. While proceeds are still well below the 2021 boom, quality deals are performing, Circle’s $1B+ IPO delivered the best first-day pop on record for its size, and the Renaissance IPO Index is outpacing the S&P 500 in 2025. The revival isn’t just a U.S. story either, cross-border listings and sector diversification are back on the table, and SPAC activity, while smaller in scale, is quietly rebounding.

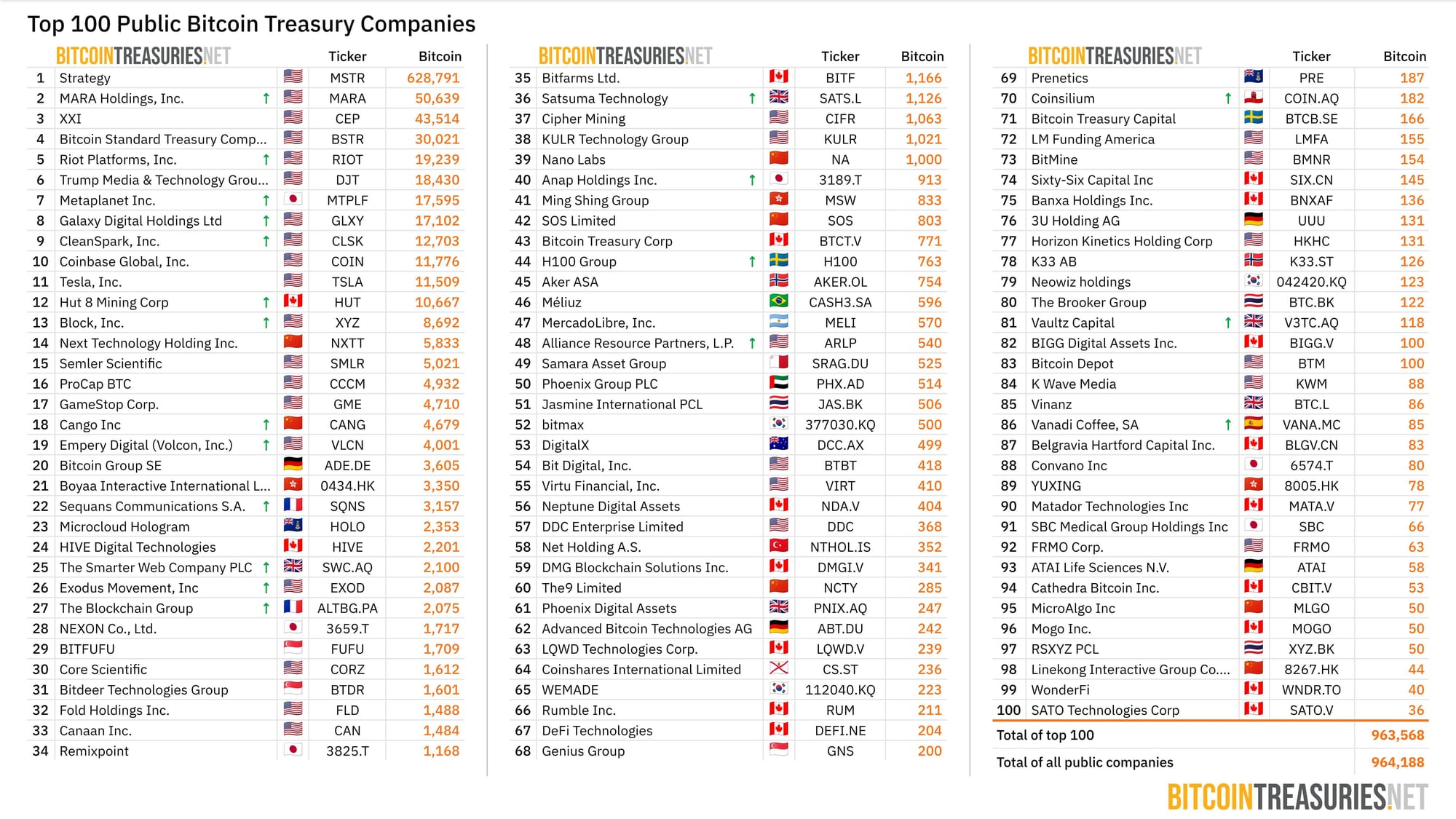

In the digital asset arena, Digital Asset Treasury (DAT) companies are carving out a new asset class in public markets. Public-company bitcoin treasuries now hold over $100 billion in BTC, up 159% year-over-year, with more than 150 companies raising nearly $100 billion in 2025 alone to buy crypto directly for their balance sheets. Stablecoin issuers like Circle and Tether are reinforcing the reserve side of the ecosystem, Circle through public-market transparency and U.S. Treasury-backed reserves, Tether with $120B+ in T-bills generating sizable yield. This corporate-scale adoption is turning listed equities into direct crypto proxies, giving investors another lever to express macro views without holding the underlying tokens.

Then there’s the online gambling boom, a sector that’s riding both legalization tailwinds and a consumer shift to digital-first betting. In 2024, U.S. commercial gaming revenue hit a record $72 billion, with sports betting accounting for $13.78 billion on nearly $150 billion in legal handle. Through May 2025, the momentum hasn’t slowed, with sports-books already booking $6.5B in revenue and monthly handles north of $12B. Thirty-eight states now have legal sports betting, about 30 of which allow mobile. Globally, Europe generated €123.4 billion in gross gaming revenue last year, nearly 40% of it online, while Ontario’s young regulated market just cleared CA$82.7B in wagers in FY 2024/25. The common thread: legislative liberalization continues to expand the addressable market, and operators with scale, compliance discipline, and efficient user acquisition strategies are best positioned to win.

From short-dated options trading to newly listed crypto treasuries, and from IPOs staging a comeback to online gambling breaking revenue records, these trends aren’t just sector-specific, they’re signaling where capital, innovation, and risk appetite are flowing in today’s market. As always, the opportunity is in spotting the overlap before everyone else does.

See which companies we believe are best suited to outperform in this risk-on market below...