Risk Management - 2026 Positioning

As we begin thinking seriously about how capital should be positioned for 2026, the market has once again entered a familiar phase: maximum narrative intensity. Blowoff tops. AI bubbles. Debt spirals. CapEx excesses. Michael Burry shorts making headlines. Every cycle has its version of this moment when fear sounds intelligent, caution feels prudent, and conviction becomes uncomfortable.

If you’ve followed our work for any length of time, you already know how we categorize this environment. We call it noise.

Not because the concerns are entirely invalid, but because the way they are being framed is designed to destabilize decision-making. Noise is what causes even disciplined investors to second-guess positions that were built with intention. It’s what turns long-term planning into short-term reaction. And it tends to appear most aggressively after extended runs, not before real structural breakdowns.

To be fair, the bearish arguments aren’t coming out of thin air. We’ve just lived through a year where new highs became routine. Valuations expanded rapidly. Capital flooded into a narrow set of narratives, AI foremost among them, and it’s natural for markets to ask whether the move has gone too far, too fast. That question, however, is very different from the conclusion that the cycle is ending.

One of the loudest narratives right now centers on debt collapse driven by AI capital expenditures. The argument goes something like this: companies are spending recklessly on infrastructure, balance sheets are being stretched, returns won’t materialize fast enough, and when funding dries up the entire structure will implode.

It sounds logical. It’s also incomplete.

The reality is that the deals are still getting done and not just being announced, but funded, expanded, and renewed. Capital isn’t freezing; it’s concentrating. Infrastructure buildouts are continuing because the demand signal hasn’t weakened. If anything, it has intensified. Using debt as evidence of imminent collapse ignores a basic truth of industrial revolutions: the build phase always looks inefficient before it looks inevitable.

More importantly, this type of spending doesn’t resolve on quarterly timelines. AI infrastructure is not a consumer app rollout. It’s a multi-year capital cycle. Historically, investments of this scale take two to three years just to stabilize, and closer to five years to fully express their return potential. Expecting immediate balance-sheet gratification misunderstands both the scope and the purpose of the investment.

Where the conversation does get interesting and where risk management actually matters is in the mismatch between technological acceleration and capital deployment.

Technology is moving faster than infrastructure can be built. That’s not a collapse signal; it’s a selection mechanism.

We’ve seen this before.

In the early Bitcoin mining era, small operators built rigs at home or at modest scale, assuming incremental growth. When technology advanced rapidly and prices were suppressed, those smaller setups were wiped out. Not because Bitcoin failed, but because efficiency became the differentiator. The miners that survived weren’t the ones who arrived first; they were the ones who could scale, optimize, and endure pressure.

The AI cycle is following the same path...just at institutional scale.

Capital expenditures won’t destroy the ecosystem. They will thin it. The winners won’t be the loudest narratives or the most aggressive spenders. They will be the platforms and systems that can operate efficiently under margin pressure, absorb volatility, and continue executing when funding conditions tighten.

This is where most market commentary falls short. The debate is framed as “AI boom or AI bust,” when the real question is who survives the digestion phase.

The answer isn’t theoretical. It’s already visible in real-world deployment.

Robotics isn’t an idea, it’s operational. Intelligence models aren’t aspirational, they’re embedded into workflows. Data processing and energy management aren’t future concerns, they’re current constraints. The companies at the forefront of these domains aren’t experimenting; they’re scaling.

And this is where end-of-year risk management becomes less about pulling capital off the table and more about rotating it with intent.

So while headlines scream about bubbles and tops, the more important work is happening underneath: capital is sorting itself. Efficiency is being rewarded. Optionality is being repriced. And patience, real patience is becoming the edge again.

This article isn’t about predicting crashes or dismissing risk. It’s about recognizing that risk changes form before it announces itself. And as we step into 2026 positioning, the goal isn’t to avoid volatility, it’s to be positioned for the phase that comes after the noise fades.

What follows will build on this framework...translating these themes into specific positioning decisions, where we’re increasing exposure, where we’re trimming, and where we’re deliberately waiting.

Because cycles don’t end when fear shows up.

They end when capital stops believing it has somewhere better to go.

Strength Beneath the Surface: Rotation, Volatility, and the Illusion of Fear

At first glance, the market backdrop feels contradictory. Headlines oscillate between confidence and catastrophe. One moment we’re discussing extended bull runs and record highs; the next, we’re warned of bubbles, blow-off tops, and systemic risk hiding just beneath the surface. Yet when we step back and examine where capital is actually moving, rather than what narratives are dominating social media and financial television, a far more coherent picture begins to emerge.

Markets have not weakened...they’ve rotated.

And that distinction matters.

Capital Rotation, Not Capital Flight

One of the most persistent misconceptions right now is that money is “leaving” equities. The charts suggest otherwise. What we’re seeing is a reallocation away from the most crowded areas of the market, particularly mega-cap technology, and into segments that lagged during the early and mid phases of this cycle such as small caps, selective cyclicals, and real-economy exposures.

This is not how bull markets end. This is how they extend.

Historically, late-stage bull markets are defined not by universal selling, but by dispersion. Leadership narrows, volatility spikes, and defensive assets begin to outperform before equities roll over. That sequence is not fully in place today. Instead, leadership is broadening again, just from different areas than where it began.

The S&P 500 charts you’ve highlighted reinforce this. Even after a roughly 45% move from the 2022 lows, price action remains constructive. Pullbacks have been orderly. Trend structure remains intact. Importantly, the index continues to respect higher lows and key Fibonacci retracement levels, suggesting that buyers remain active on weakness, not absent.

This behavior aligns closely with what we typically see four to six months into a rate-cut cycle. Liquidity conditions improve incrementally, but risk-taking doesn’t surge indiscriminately. Instead, capital looks for areas where valuation compression already occurred and small caps fit that profile almost perfectly.

Volatility: The Quiet Confirmation

Perhaps the most under appreciated signal in your analysis is the volatility index itself.

The long-term VIX chart shows something that’s easy to overlook if you’re only watching daily price action: volatility has spent extended periods compressing at structurally low levels following major macro shocks. The post-2016 election environment, the post-2018 rate-hike correction, and the post-2022 bear market all share a common feature...once volatility stabilized and failed to make higher highs, equities trended higher for far longer than most expected.

The current VIX setup looks eerily similar.

We’re not seeing panic. We’re not seeing disorderly spikes. Instead, volatility is oscillating within a defined range, suggesting that risk is being repriced, not feared. That’s a critical difference. Sustained bull markets don’t require zero volatility, they require contained volatility.

When the VIX refuses to break higher despite geopolitical stress, tariff headlines, and macro uncertainty, it’s telling you something important: the market is absorbing information, not reacting emotionally to it.

This is exactly the environment where extended trends persist, not explode, not collapse, but grind higher while frustrating both bulls and bears.

Equity Structure Still Matters

Meanwhile, the NASDAQ and broader tech complex appear to be doing exactly what they should after a dominant run...consolidating. The QQQ chart shows price compressing near prior highs, respecting key moving averages, and avoiding any kind of impulsive downside. This isn’t distribution. It’s digestion.

Markets don’t unwind excess in straight lines. They do it through time. Sideways ranges, failed breakouts, and rotational underperformance are far healthier outcomes than sharp declines. This process allows valuations to normalize without destroying trend structure and it creates opportunity elsewhere.

That “elsewhere” is increasingly visible in small caps and under-owned sectors, where balance sheets are improving, rate sensitivity is declining, and expectations remain muted.

Precious Metals: Signaling Risk or Reflecting Excess?

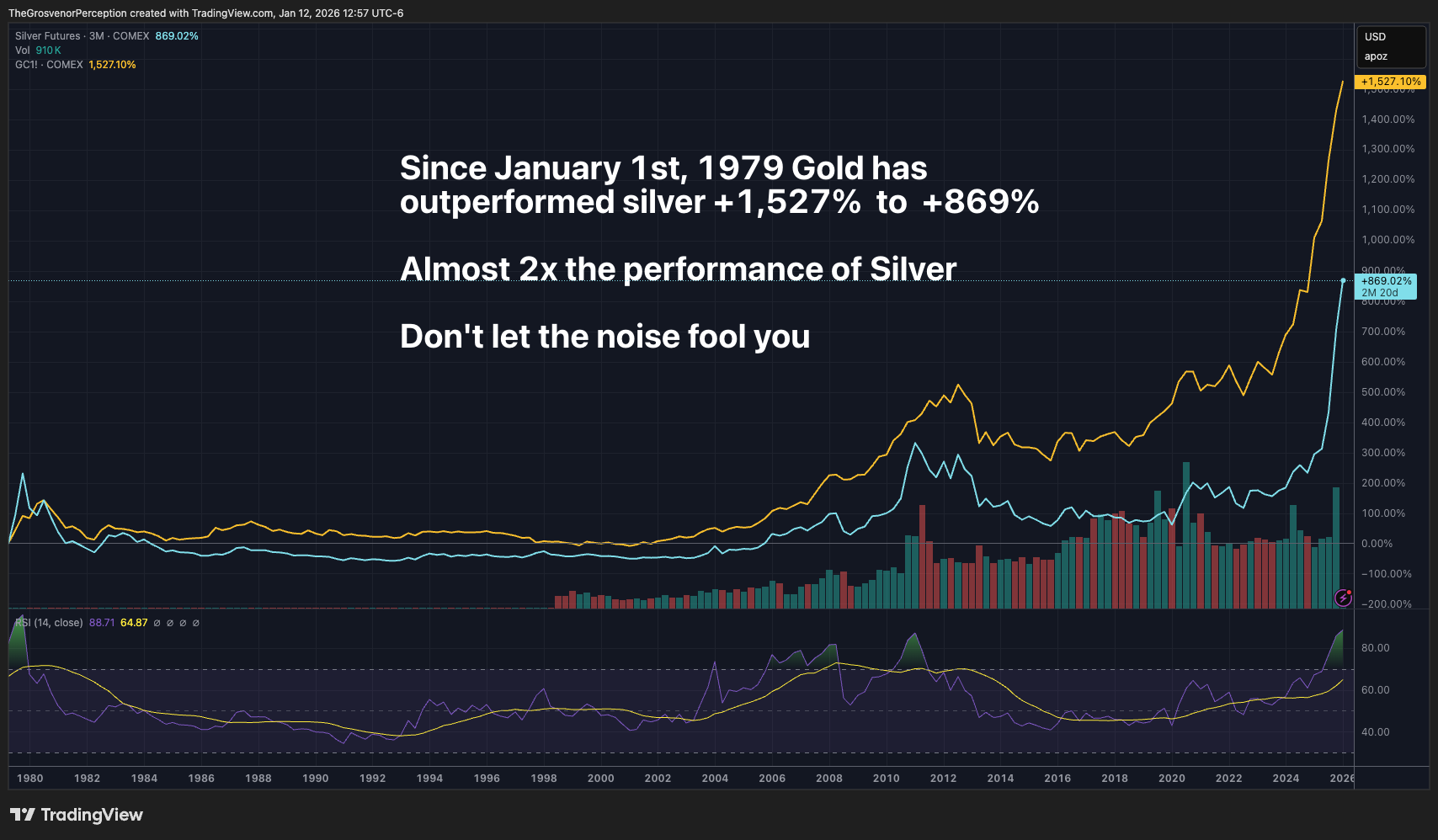

Gold and silver are perhaps the most emotionally charged parts of the current market conversation. On the surface, their performance suggests that “something bad” must be coming. Gold has dramatically outperformed silver over the last four decades, nearly doubling its long-term return. Silver, meanwhile, is experiencing a parabolic-style move that naturally attracts late-cycle speculation.

But price alone is not a signal. Context is everything.

The charts highlight an important truth that often gets lost: gold’s outperformance has been structural, not reactive. Central bank accumulation, reserve diversification, and currency debasement have driven gold’s role as a long-duration store of value. Silver, on the other hand, tends to behave as a high-beta expression of macro enthusiasm...it underperforms for decades, then surges violently when sentiment flips.

That’s where caution is warranted.

Silver’s current breakout through long-term resistance and Fibonacci extensions looks impressive, but history suggests that these moves are often followed by brutal mean reversion. When everyone agrees that precious metals are the “only safe place,” risk-reward often deteriorates rapidly.

Gold and silver are not wrong, but they may be early. And at these levels, potentially crowded. This doesn’t invalidate their role in a portfolio, but it does challenge the idea that chasing them here is prudent risk management.

In other words, precious metals may be signaling uncertainty, not imminent collapse.

The Bigger Picture

Taken together, these charts tell a consistent story:

- Equity markets remain structurally strong.

- Capital is rotating, not fleeing.

- Volatility is contained, not erupting.

- Precious metals are acting like fear assets, but possibly ahead of their moment.

- Small caps and laggards are beginning to re-enter the conversation.

This is not the anatomy of a market on the brink. It’s the anatomy of a market rebalancing internally.

That distinction will matter enormously as we move deeper into 2026 positioning. Risk management here doesn’t mean abandoning exposure. It means being selective, resisting narrative extremes, and understanding that markets often look most confusing right before they make their next sustained move.

In the sections that follow, we’ll begin translating this framework into specific positioning decisions...where we’re leaning into rotation, where we’re reducing asymmetrical risk, and where patience remains the highest-conviction trade.