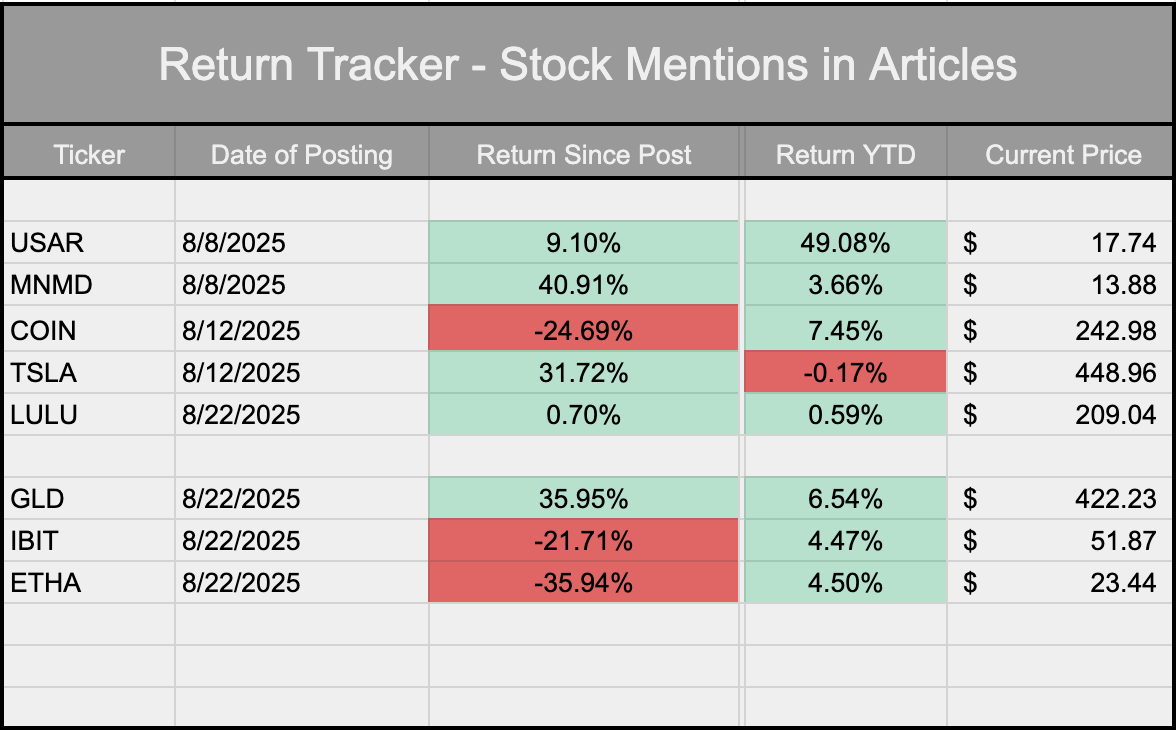

Position Updates from 2025

Here is a list of overall returns and YTD returns of stocks that we covered in our newsletter in 2025.

The S&P 500 continues to trade within a well-defined upward structure, but the character of price action has shifted. After a strong advance off the September FOMC cut, the index is now pressing the upper bounds of its rising channel, where momentum has begun to stall rather than accelerate.

One of the more important features on the chart is the repeated cluster of doji candles near recent highs. This isn’t outright distribution, but it is a clear signal of indecision. Buyers are still present, yet conviction has faded as price struggles to cleanly push higher without immediate follow-through. Historically, this type of behavior near the top of a channel tends to resolve with a reset rather than a straight-line continuation.

From a trend perspective, the primary structure remains intact. Higher highs and higher lows are still being respected, and any pullback that holds above prior breakout levels would be technically constructive. The most logical area for that to occur sits in the 6,500–6,700 range, where former resistance, rising trend support, and prior consolidation overlap. That zone represents an ideal area to evaluate risk rather than chasing strength at the highs.

Momentum indicators support this interpretation. RSI has cooled without breaking down, suggesting digestion rather than exhaustion, while MACD has rolled over modestly after a strong thrust, again pointing toward consolidation or a controlled pullback.

The trend is still up, but price is no longer being rewarded for impatience. The market looks more interested in shaking out weak hands and resetting expectations before its next meaningful move.

$USAR - USA Rare Earth

This marks the latest position update on USA Rare Earth ($USAR) as the company continues its transition from concept to execution. The core thesis remains intact: build a vertically integrated, non-China rare-earth and magnet supply chain at a time when industrial reshoring and national security concerns are no longer theoretical. What has changed is the degree of operational clarity—and the market’s attempt to price it in before revenues arrive.

From a price perspective, the stock has responded. Shares are up roughly 50% year-to-date, a respectable move, though still well off prior highs and lagging some of the more mature names in the space. Technically, $USAR sits in a conflicted zone, below its 50-day moving average but above its 200-day, suggesting the market is neither abandoning the story nor fully committing to it. This is typical of companies still proving infrastructure rather than monetizing it. Relative underperformance versus peers like MP Materials and NioCorp Developments largely reflects that distinction: revenue visibility versus build-out risk.

Fundamentally, $USAR remains in heavy investment mode. The company is pre-revenue and continues to absorb elevated SG&A and R&D costs tied to staffing, consulting, engineering, and facility development. Losses persist, and near-term financials will remain unflattering by traditional metrics. That said, the balance sheet is not the constraint. With over $400 million raised, management has the capital required to complete plant upgrades, expand magnet-finishing capabilities, and scale production capacity without immediate dilution pressure.

Where the story meaningfully advances is on the strategic front. The acquisition of Less Common Metals Ltd. LCM is the largest rare-earth metals and alloys producer outside China and, critically, the only proven Western producer of both light and heavy rare-earth magnet metals. Its 67,000-square-foot facility in the UK provides $USAR with immediate, real-world manufacturing capability rather than aspirational capacity. Just as important, LCM brings closed-loop recycling and scrap recovery, improving long-term economics while aligning with defense, sustainability, and government procurement priorities.

This acquisition materially accelerates the mine-to-magnet strategy and places $USAR in a unique position: one of the few Western companies capable of delivering an end-to-end rare-earth solution. That positioning is further reinforced by early commercial validation. A memorandum of understanding with Enduro Pipeline Services to supply neodymium magnets, targeting production in early 2026, signals that customer conversations are moving beyond theory and into application.

Looking forward, the Stillwater magnet facility in Oklahoma remains the operational linchpin. Commissioning is targeted for early 2026, and execution there will ultimately determine whether the thesis converts into cash flow. Until then, volatility should be expected. For existing holders, this remains a long-duration build where progress must be measured in milestones, not quarters.

Want to learn more about our strategy with $USAR and our main conviction points? Click the link below👇

$MNMD - Mind Medicine - Now Definium Therapeutics $DFTX

This update sits at the intersection of positioning and timing. Over the past several months, a number of holdings across the portfolio have moved out of the idea phase and into execution mode. $USAR is one example on the industrial and supply-chain side. On the healthcare side, Definium Therapeutics formerly MindMed, now enters a similar stretch where outcomes begin to matter more than narratives. That shift changes how risk should be framed and how progress should be evaluated.

Link to the Official Press Release Here

Definium’s story has quietly matured. What began years ago as exploratory psychedelic research has consolidated into a focused late-stage psychiatry platform built around a single lead asset, DT120 ODT. The drug targets generalized anxiety disorder and major depressive disorder, two conditions affecting tens of millions of patients and an area of medicine that has seen remarkably little pharmacological innovation in nearly two decades. This is not an incremental reformulation chasing marginal benefit; earlier-stage data showed efficacy well beyond existing standards with a tolerability profile that regulators have already recognized through Breakthrough Therapy Designation in GAD.

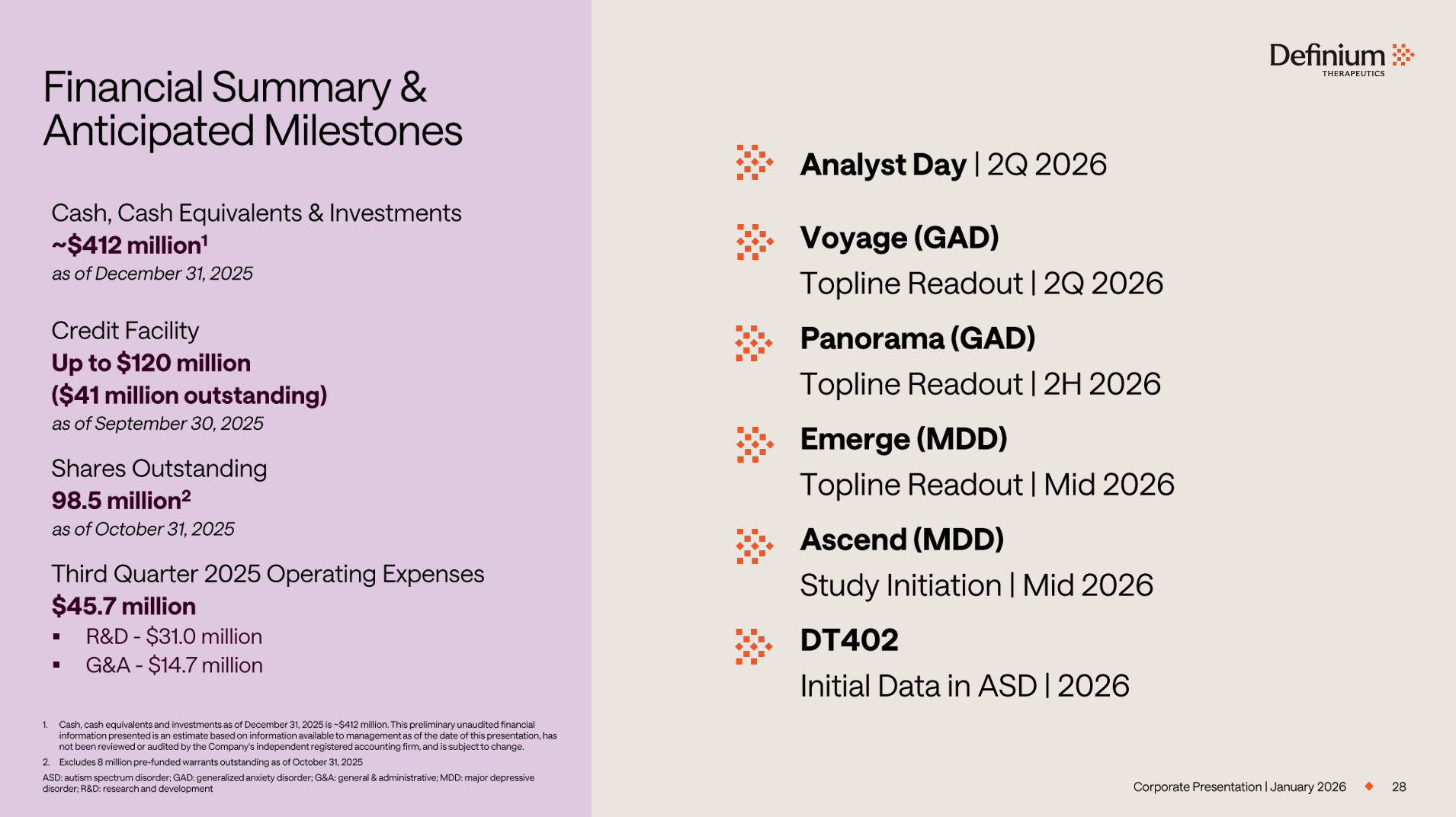

The calendar is now clearly defined. Three Phase 3 readouts are scheduled across 2026, beginning with Voyage in the second quarter, followed by Panorama in the back half of the year, and Emerge for depression around mid-year. Together, these trials form the fulcrum of the investment case. Positive data would shift DT120 from a promising asset to a regulatory and commercial contender. Weak or mixed data would reset expectations quickly. There is very little ambiguity left, which is exactly where disciplined investors want a story to be.

What makes this setup more compelling is that Definium is not approaching these data events under financial stress. The company enters 2026 with roughly $259 million in capital, enough to fund ongoing trials, prepare regulatory submissions, and begin outlining a commercial strategy without immediately returning to markets. At the same time, development continues beyond the flagship program. A second Phase 3 depression study is planned to begin mid-year, and an autism-spectrum asset has already entered Phase 2a dosing, adding optionality without distracting from the core thesis.

The recent rebrand and ticker change to $DFTX should be understood as positioning rather than marketing. Management is clearly signaling that the company views itself as a late-stage psychiatric drug developer, not an early experimental platform. Upcoming visibility at major healthcare conferences and a planned analyst day reinforce that posture. If the data supports it, Definium wants to be evaluated on launch readiness, market size, and durability.

From a market perspective, the stock’s sharp advance over the past six months reflects anticipation, not confirmation. Momentum has improved, but from here forward price action will increasingly mirror trial timelines and investor positioning around binary events. That is typically where volatility increases and conviction is tested. This is no longer a “buy the idea” phase. It is a “hold through evidence” phase.

The broader takeaway is straightforward. Like $USAR on the industrial side, Definium is approaching the point where execution replaces vision. The roadmap is no longer hypothetical, the capital stack is intact, and the timeline is fixed. Whether this position evolves into a long-duration compounder or retraces into optionality will be decided by data. That clarity, while uncomfortable, is ultimately what creates opportunity.

$COIN - Coinbase Inc.

Coinbase has been the one position we’ve covered that hasn’t lived up to expectations so far, and there’s no value in dancing around that. After our initial coverage in August 2025, the stock did what we wanted it to do at first...rallying close to 25% in the weeks that followed, but the move ultimately lacked staying power. As of today, shares are down roughly 20% from that initial entry.

That underperformance didn’t happen in isolation. The broader crypto market has been bleeding market cap for months, not through a dramatic crash, but through sustained volatility and exhaustion. In hindsight, the timing of the Digital Asset Treasury narrative in August 2025 marked a near-perfect sentiment peak. Bitcoin printed new all-time highs, Ethereum followed briefly for a couple of days, and then momentum faded almost immediately. Since then, crypto has behaved exactly as it tends to after euphoric phases... choppy, directionless, and unforgiving to anything levered to activity and sentiment.

Add to that a largely stagnant fourth quarter across risk assets, and it becomes easier to understand why Coinbase struggled. When volatility compresses and participation dries up, exchanges feel it first.

What matters now is where the stock has landed and how it’s behaving.

As the chart makes clear, Coinbase has spent a meaningful amount of time consolidating below its 200-day moving average, oscillating cleanly between the 0.500 and 0.618 Fibonacci retracement levels. This isn’t sloppy price action. It’s orderly, repetitive, and increasingly compressed. Historically, when $COIN has spent time building a base in this exact zone, it hasn’t resolved lower, it’s eventually moved higher after volatility contracted and sellers exhausted themselves.

That’s not a guarantee, but it is a familiar setup.

The more important observation is what isn’t happening. The stock isn’t making new lows. Downside momentum has slowed materially. Each selloff attempt is being absorbed within the same range. For a name that trades as a proxy for sentiment, that kind of behavior usually signals stabilization, not breakdown.

Because of that, and because a meaningful discount is now embedded in the stock, we’re adding to our Coinbase position at current levels. This isn’t a reactionary move, it’s a calculated one. Averaging into this range allows us to improve our cost basis while positioning ahead of a potential resolution higher out of consolidation.

Since September, Coinbase has continued to do the right things strategically. The business is no longer just a spot exchange tied to retail speculation. It has expanded deeper into derivatives, institutional infrastructure, custody, and crypto-linked financial products that actually benefit from ETF adoption rather than compete with it. While ETFs have diverted some spot volume, they’ve also expanded the total market, increased derivatives activity, and reinforced Coinbase’s role as underlying infrastructure instead of a front-end on-ramp.

From here, the plan is straightforward. We’ll continue accumulating within this consolidation zone, treating it as base-building rather than failure. If and when price revisits prior all-time highs, we’ll be disciplined about booking profits on a portion of the position. At the same time, we intend to hold a meaningful long-term allocation, aligned with the view that Coinbase remains one of the most important public companies in the digital asset ecosystem.

From current levels, a move back toward prior highs implies roughly 70% upside. Given the defined range, the structural setup, and the evolution of the business itself, that risk-reward remains compelling.

Coinbase hasn’t been easy. But easy trades rarely offer the best asymmetry. The stock is consolidating where it has historically resolved higher, the company continues to expand beyond a single revenue stream, and pessimism is already well priced in. For those reasons, we’re not walking away from this position—we’re leaning into it, with a plan, patience, and clear expectations.

$TSLA - Tesla Inc.

Tesla has slipped back into a familiar position in the market. One where it’s no longer being traded purely as an automaker, but as a proxy for belief, leverage, and future optionality. Since September 2025, the stock’s movement has had far less to do with unit sales or near-term margins and far more to do with how investors are choosing to price autonomy, software, and platform-scale ambition.

That shift shows up clearly on the chart.

After pushing to new highs late last year, Tesla stalled just below the prior all-time high near the $488 area. The pullback that followed, roughly 11–12% from the highs, looks dramatic in isolation, but in the context of Tesla’s history, it’s almost routine. This is a stock that rarely trends in straight lines. It surges, compresses, resets positioning, and then decides whether the next move is earned by fundamentals or forced by momentum.

Right now, price is doing exactly that...digesting, not breaking.

The weekly chart shows Tesla still holding its broader upward structure, even as short-term momentum cools. RSI has slipped out of overbought territory into the high-50s, a zone that typically reflects indecision rather than exhaustion. More importantly, price has not violated any of the structural levels that would suggest distribution. Instead, it’s hovering in a range that feels less like rejection and more like the market asking a question: what, exactly, is Tesla worth in this cycle?

Fundamentally, the answer has become more nuanced over the past several months.

On the surface, Tesla’s automotive business remains solid but unspectacular. Margins continue to face pressure from pricing competition, policy friction, and tariff-related noise. Cybertruck, once viewed as a near-term growth engine, has introduced more questions than clarity...ranging from production complexity to demand durability. None of that is catastrophic, but it does temper the idea that vehicles alone justify premium valuation expansion in the near term.

Where the narrative has quietly strengthened is everywhere else.

Tesla’s energy business has continued to scale, posting record storage deployments into late 2025 and reinforcing its role in the same power infrastructure buildout that’s now underpinning AI data centers globally. Energy doesn’t get the same headlines as autonomy, but it adds something arguably more important: stability. It’s a reminder that Tesla’s revenue base is becoming more diversified at exactly the time markets are rewarding durability.

Then there’s software.

The most meaningful shift since September isn’t a product launch, it’s a business model decision. Tesla’s move to transition Full Self-Driving to a subscription-only offering starting in early 2026 is a signal to the market that recurring revenue, adoption curves, and lifetime value are now front and center. That matters because markets don’t value subscriptions the same way they value hardware sales. Subscription models invite multiples, not just margins.

This is where Tesla starts to behave more like Coinbase than Ford.

Coinbase trades as a function of participation, volatility, and optionality. Tesla does too, just at a much larger scale. When risk appetite is strong, investors don’t ask whether autonomy is fully solved; they price the possibility that it will be. When risk appetite cools, they pull back leverage, volatility compresses, and the stock retraces, often quickly, often emotionally.

The current pullback fits that pattern almost too cleanly.

Options positioning has reset. Momentum traders have lightened exposure. And price has drifted back toward levels that would feel uncomfortable for late buyers but attractive to longer-term allocators. The $404 zone on the chart stands out as the first area where real demand could step in if selling persists, with deeper structural support much lower only if the broader market flips decisively risk-off.

That’s an important distinction. A retracement is not a rejection of the thesis. It’s a recalibration of timing.

What Tesla is forcing investors to confront right now is simple: are you paying for what the company is today, or for what it might become? If Tesla is just an automaker with some optionality, upside is capped and pullbacks deserve skepticism. If Tesla is evolving into a platform spanning energy, software, autonomy, and infrastructure then pauses like this are not failures, they’re invitations.

That’s why Tesla continues to function as a market psychology tell. When Tesla and Coinbase are both being accumulated, risk appetite is expanding. When they stall or retrace, it’s rarely about collapse...it’s about leverage being repriced.

At this point, Tesla isn’t flashing warning signs. It’s flashing patience tests.

A decisive reclaim of the prior high near $488 would signal the market is ready to reprice narrative leadership again. Failure to do so doesn’t break the story, it simply forces a longer base and better entries. Either outcome still keeps Tesla squarely in the conversation as one of the most important sentiment-driven equities in the market.

$LULU - Lululemon Athletica Inc.

Lululemon’s journey over the past few months has been a study in endurance over excitement. After kicking off our coverage with optimism, the stock stumbled soon after...shares plunged in 2025 as U.S. demand softened, margins tightened under tariff pressures, and brand competition ramped up. That rough patch could have shaken lesser investors loose, but we didn’t blink. Why? Because nothing about Lululemon’s swing was a sudden breakdown, it was a messy digestion that only felt ugly due to the broader market’s relentless expectations for perfection.

If you look at the weekly chart, what stands out isn’t chaos but structure. After the late-2024/early-2025 rally hit a ceiling, price carved a broad base all through the latter part of last year, bouncing between key horizontal ranges and hugging the lows with decreasing volatility. That accumulation pattern into the end of 2025 wasn’t a coincidence...it was the market saying “we’re processing information, not panicking.” That same sense of indecision you’ve seen across global markets has shown up here too: extended bull runs, geopolitical tensions, election cycles heating up, gold and silver flashing risk aversion, and supply chain concerns with China all layering a fog of uncertainty over consumer-cyclical names.

But beneath that macro noise, Lululemon hasn’t been idle.

Outside the normal cadence of earnings and retail cycles, the company has been actively reshaping its growth architecture. In Q3 2025, revenue came in up roughly 7% with international sales, especially in China, surging even as U.S. comparable sales lagged. It was enough to beat expectations but not enough to silence skepticism about margins and core market traction. Shortly after, the board pulled the CEO out of the spotlight, Calvin McDonald stepped down amidst back-and-forth criticism from founder Chip Wilson and mounting pressure from an activist investor.

Rather than retreat, the company used the end of the year to recalibrate its leadership and strategic priorities. CFO Meghan Frank is now serving as co-CEO alongside Chief Commercial Officer André Maestrini, a move that signals a reset rather than a retreat. Recent guidance for the fourth quarter of fiscal 2025 reflects that: Lululemon now projects both revenue and earnings toward the high end of prior ranges, driven by a surprisingly strong holiday season, remarkably resilient considering the backdrop.

International expansion has been another under-the-radar but important thread. The brand plans to enter six new countries in 2026, including Greece, Austria, Poland, Hungary, Romania, and India via franchise partnerships...its largest single-year expansion push ever. That isn’t a vanity project; it’s a deliberate hedging of risk by broadening the customer base and revenue mix outside North America.

And there’s even a symbolic win that gets lost in the weeds of charts and earnings: Lululemon’s first-ever NFL apparel partnership. That may sound like a lifestyle branding move, but it signifies something deeper, an appeal far beyond yoga studios and boutique runners, into mainstream, male-skewed fan demographics that Lululemon previously struggled to reach.

On the chart itself, you can see the technical story woven into these fundamentals. Price has tentatively moved off the lows near the 0 level (~$159) and is flirting with resistance around the region that maps near the 0.236 retracement (~$243), a zone that also intersects trendline/moving average confluence. That “real estate” on the chart isn’t random it’s the technical equivalent of market skepticism turning into tentative belief. Into this year, Lululemon has already outpaced the S&P 500 by a substantial margin: while the S&P has clawed out ~+3%, Lululemon has mustered close to +21%, a testament to buyers stepping in where sentiment was previously washed out.

This price behavior matches what we’ve seen in longer cycles: choppy, range-bound action followed by incremental bids from informed participants as fundamentals reaffirm commitment. There’s no “blowoff” breakout yet, but what is happening is legitimization, shares are being accumulated, not abandoned.

The narrative here is not that Lululemon is fixed and roaring back, but rather that the brand’s strategic evolution and disciplined execution have earned it a seat at the table of long-term structural plays, not just a trendy athleisure story. International growth, refreshed leadership, brand diversification, and real top-line resilience last holiday season paint a more textured picture than the stock’s early underperformance.

What matters most now isn’t perfection in the short-term chart prints; it’s that we see the elements aligning for a sustainable re-rate rather than a dead-cat bounce. This isn’t a straight line back to all-time highs, but it is a market behavior that suggests conviction is returning...buyers are stepping in where fear once dominated.

If you’re watching Lululemon today, you’re watching a brand behave like a living company in a living market, not a broken one. That nuance is exactly why we didn’t bail when others did, and why we believe this setup deserves respect as much as attention.

If you want deeper visibility into how we’re positioning capital...

Why we’re holding what we hold, where we’re adding exposure, and what we’re watching next...

Our paid members get that access first. New positions are shared exclusively with subscribers, alongside ongoing, high-resolution coverage of commodities, crypto, and the broader macro landscape. Checkout our tiers below👇

Outperform at Your Own Risk 📈

Disclosure Statement for The Grosvenor Perception

Last Updated: 08/02/25

General Disclaimer

The Grosvenor Perception (“we,” “our,” or “the publication”) is a financial newsletter published by Michael Harbin. All content published in this newsletter, whether online, in email, or through any affiliated platforms, is intended for informational and educational purposes only. None of the information contained herein constitutes investment, financial, legal, or tax advice.

The views expressed in The Grosvenor Perception represent the personal opinions and analysis of the writers and contributors as of the date published and are subject to change at any time without notice. These opinions do not reflect the views of any affiliated institutions, employers, or entities.

No Investment Advice or Recommendations

The Grosvenor Perception is not a registered investment advisor, broker-dealer, or financial planner. We are not licensed under the U.S. Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or any other regulatory agency in any jurisdiction to provide personalized financial advice or investment recommendations.

Nothing published in this newsletter or on our website should be construed as a solicitation, offer, or recommendation to buy, sell, or hold any security or financial instrument. Subscribers and readers are solely responsible for their own investment decisions and should consult a licensed financial advisor, tax professional, or legal advisor before making any financial or investment decisions.

No Guarantee of Results or Performance

While we strive to provide accurate and up-to-date information, The Grosvenor Perception does not guarantee the accuracy, completeness, timeliness, or reliability of any information contained in our content. Financial markets are inherently uncertain and subject to numerous variables; past performance is not indicative of future results.

We disclaim all liability for any errors, omissions, or inaccuracies in the information presented. We make no representations or warranties—express or implied—regarding the effectiveness or profitability of any strategy, investment, or analysis discussed.

Forward-Looking Statements and Speculative Content

Some content in The Grosvenor Perception may contain forward-looking statements, projections, or speculative commentary, which are inherently uncertain and involve risks. These statements reflect our best judgment and interpretation at the time of publication but may not materialize as anticipated due to factors beyond our control.

Conflicts of Interest and Compensation

Writers and contributors to The Grosvenor Perception may have personal investments in securities or assets mentioned in the publication. Any such positions are not intended as recommendations and may be disclosed at the discretion of the author.

The newsletter may also contain sponsored content or affiliate links for which we may receive compensation. Any such material will be clearly marked in accordance with applicable FTC guidelines.

Copyright and Distribution

All content published in The Grosvenor Perception, including text, images, logos, and branding, is the intellectual property of Michael Harbin and is protected under applicable copyright laws. Unauthorized reproduction, redistribution, or public display of any portion of our content without written permission is strictly prohibited.

Jurisdiction and Legal Compliance

This publication is intended for a U.S.-based audience and is governed by the laws of the State of Florida, without regard to its conflict of laws principles. Access to the content of The Grosvenor Perception may not be legal for individuals in certain jurisdictions. It is the responsibility of the reader to ensure compliance with their local laws and regulations.

Contact Information

If you have questions about this disclosure or wish to contact the publisher of The Grosvenor Perception, please reach out to:

The Grosvenor Perception

admin@grosvenorperception.com

By reading this newsletter or accessing our content, you acknowledge that you have read, understood, and agreed to the terms outlined in this disclosure.

Member discussion