Is the AI Bubble Going to Pop?

The defining market story of the past two years has been the AI trade. We’ve witnessed historic runs across a number of companies capitalizing on artificial intelligence’s rapid rise to mainstream adoption. Along the way, we’ve hit several milestones: the world’s first-ever $4 trillion company, 100% rallies in major names since the April 7th bottom, and fresh all-time highs in both the S&P 500 and the NASDAQ.

That naturally begs the question: when does this trade stop—or does it ever lose momentum?

So far, short-sellers have been steamrolled. Each attempt to call the top of the “AI bubble” has resulted in wave after wave of liquidations. With such strong forward outlooks for the MAG7 names, it’s difficult to imagine a sharp correction, at least in the near term. But history reminds us that no trade runs in a straight line forever, and sector rotation is a narrative that continues to circulate among institutional investors.

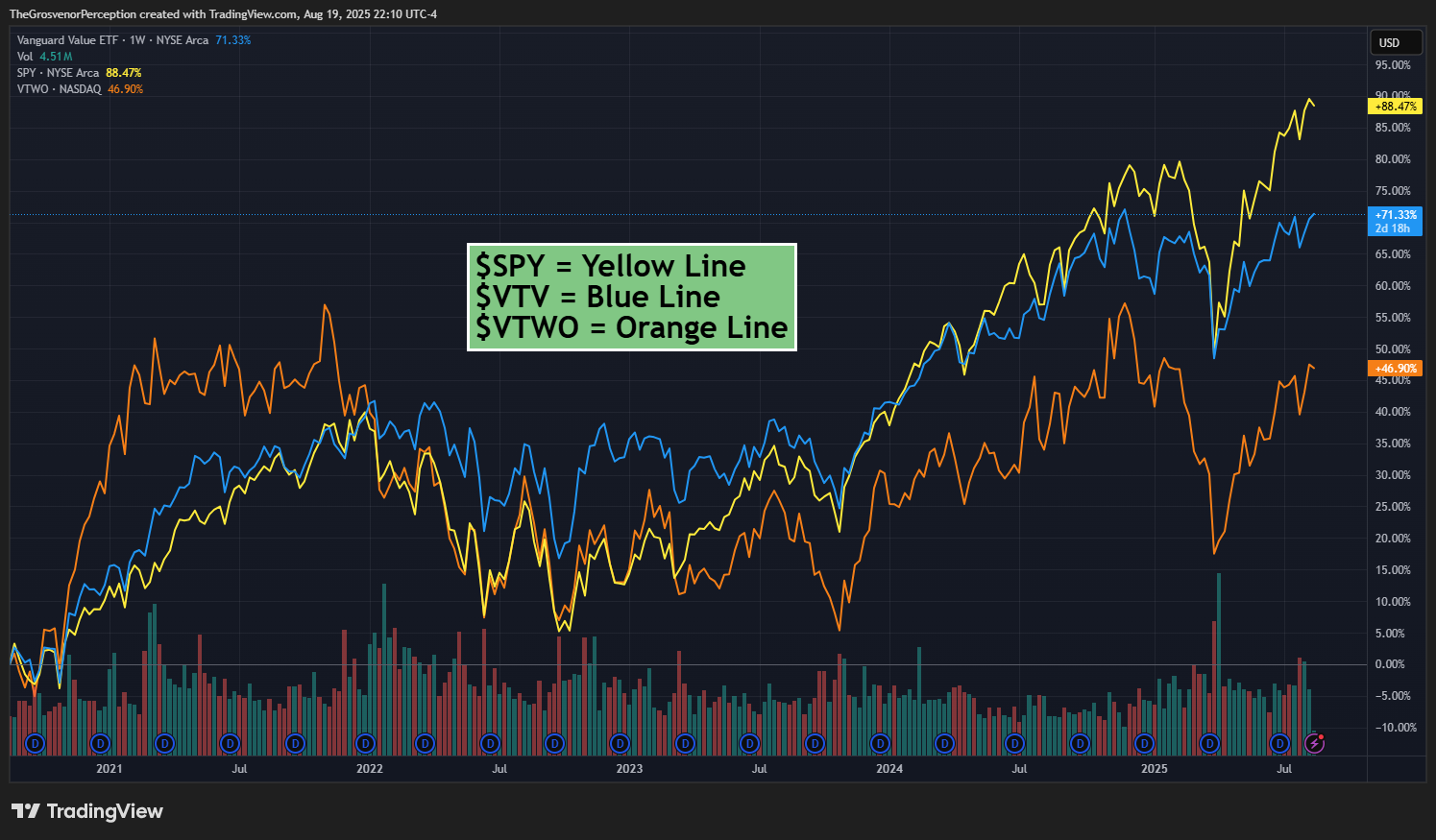

One well-worn playbook is the rotation from growth into value. This is a classic tool for both advisors managing client portfolios and asset managers seeking to reduce volatility. The rationale is straightforward: when growth stocks stumble, value often holds up better. A prime example came in 2022, when growth names suffered steep drawdowns while value stocks provided relative shelter during one of the worst market years in decades.

Over the past five years, however, the picture has been very different. Value and small caps have significantly underperformed, with value only showing relative strength during the 2022 bear market. This underperformance leaves investors wondering whether another rotation could rebalance leadership—or whether mega-cap tech remains the only game in town.

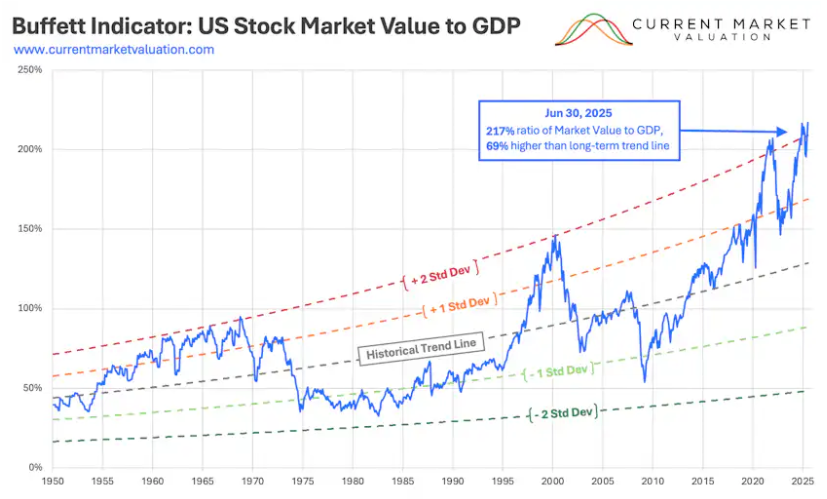

One valuation tool that often resurfaces in these discussions is the Buffett Indicator, which compares the total U.S. stock market value to GDP. Prior to the 2022 bear market, the indicator peaked above 200%, roughly 69% higher than the long-term trend line and more than two standard deviations above historical norms. Even today, it remains elevated, suggesting valuations are stretched and reinforcing the notion that the AI-driven rally may, in fact, reflect bubble dynamics.

Some of the most eye-catching examples of stretched valuations include Palantir ($PLTR) and newly public names like Circle Internet Group ($CRCL) and CoreWeave ($CRWV). These stocks enjoyed massive upside earlier this year but have since pulled back aggressively, reflecting growing discomfort around their lofty multiples.

Still, labeling this moment a “bubble” misses some of the nuance. While there are parallels to past speculative cycles, the AI infrastructure buildout is still in its earliest innings. The capital flowing into data centers, chip design, energy systems, and enterprise software is unlike anything we’ve seen before in a single sector. To borrow a metaphor: if you’ve ever been knocked off your feet by a wave at the beach, imagine one 100x bigger. That’s the scale of liquidity and investment energy flowing into AI today.

A useful historical comparison might be the oil supermajors in the 1970s and 1980s. To fuel decades of growth, they invested heavily in offshore drilling and global infrastructure. Today, big tech is making an analogous bet pouring unprecedented sums into building the backbone of the AI economy.

So how do investors position when the market could move in either direction? That’s the challenge and the opportunity. Timing a bubble is notoriously difficult, but ignoring the scale of the AI wave is equally dangerous.

👉 For a deeper dive into portfolio positioning, including how we’re thinking about Risk-On vs. Risk-Off strategies, check out our latest article linked above.

Disclosure Statement for The Grosvenor Perception

Last Updated: 08/02/25

General Disclaimer

The Grosvenor Perception (“we,” “our,” or “the publication”) is a financial newsletter published by Michael Harbin. All content published in this newsletter, whether online, in email, or through any affiliated platforms, is intended for informational and educational purposes only. None of the information contained herein constitutes investment, financial, legal, or tax advice.

The views expressed in The Grosvenor Perception represent the personal opinions and analysis of the writers and contributors as of the date published and are subject to change at any time without notice. These opinions do not reflect the views of any affiliated institutions, employers, or entities.

No Investment Advice or Recommendations

The Grosvenor Perception is not a registered investment advisor, broker-dealer, or financial planner. We are not licensed under the U.S. Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), or any other regulatory agency in any jurisdiction to provide personalized financial advice or investment recommendations.

Nothing published in this newsletter or on our website should be construed as a solicitation, offer, or recommendation to buy, sell, or hold any security or financial instrument. Subscribers and readers are solely responsible for their own investment decisions and should consult a licensed financial advisor, tax professional, or legal advisor before making any financial or investment decisions.

No Guarantee of Results or Performance

While we strive to provide accurate and up-to-date information, The Grosvenor Perception does not guarantee the accuracy, completeness, timeliness, or reliability of any information contained in our content. Financial markets are inherently uncertain and subject to numerous variables; past performance is not indicative of future results.

We disclaim all liability for any errors, omissions, or inaccuracies in the information presented. We make no representations or warranties—express or implied—regarding the effectiveness or profitability of any strategy, investment, or analysis discussed.

Forward-Looking Statements and Speculative Content

Some content in The Grosvenor Perception may contain forward-looking statements, projections, or speculative commentary, which are inherently uncertain and involve risks. These statements reflect our best judgment and interpretation at the time of publication but may not materialize as anticipated due to factors beyond our control.

Conflicts of Interest and Compensation

Writers and contributors to The Grosvenor Perception may have personal investments in securities or assets mentioned in the publication. Any such positions are not intended as recommendations and may be disclosed at the discretion of the author.

The newsletter may also contain sponsored content or affiliate links for which we may receive compensation. Any such material will be clearly marked in accordance with applicable FTC guidelines.

Copyright and Distribution

All content published in The Grosvenor Perception, including text, images, logos, and branding, is the intellectual property of Michael Harbin and is protected under applicable copyright laws. Unauthorized reproduction, redistribution, or public display of any portion of our content without written permission is strictly prohibited.

Jurisdiction and Legal Compliance

This publication is intended for a U.S.-based audience and is governed by the laws of the State of Florida, without regard to its conflict of laws principles. Access to the content of The Grosvenor Perception may not be legal for individuals in certain jurisdictions. It is the responsibility of the reader to ensure compliance with their local laws and regulations.

Contact Information

If you have questions about this disclosure or wish to contact the publisher of The Grosvenor Perception, please reach out to:

The Grosvenor Perception

admin@grosvenorperception.com

By reading this newsletter or accessing our content, you acknowledge that you have read, understood, and agreed to the terms outlined in this disclosure.

Member discussion