Deregulatory Environment Fueling Bull Market - Positioning After of The Fed

Markets don’t run higher in a vacuum. Every cycle has a catalyst, and in 2025, the backdrop is unmistakable: a deregulatory environment that has opened the floodgates for speculation, risk-taking, and capital flows. From leveraged ETFs to prediction markets, from the IPO surge to crypto ETFs, the financial system has been recast in a way that blurs the line between investing and gambling.

The Federal Reserve’s shift away from restrictive policy has been an accelerant. With rate cuts beginning to filter through the system, liquidity is finding its way into every corner of the market. But unlike prior cycles, this isn’t just about equities and bonds. It’s about new instruments, new products, and a cultural shift toward embracing risk as entertainment and investing as speculation.

The question now isn’t whether this bull market has legs. The question is how to position when the market itself is being fueled by instruments designed to amplify volatility and chase asymmetric payoffs. In this piece, we break down the mechanics driving the expansion specifically with leveraged ETFs, prediction markets, digital asset ETFs, IPO flows, and online gambling and outline what it all means for investors navigating the next phase of this cycle.

Digital Asset ETF Market

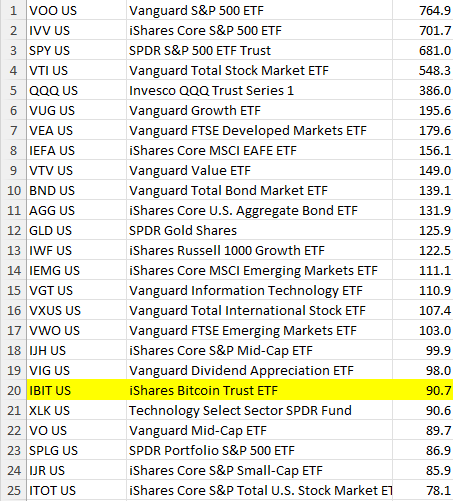

The crypto ETF space in 2025 has hit a turning point. Active funds now manage roughly $153.8B in assets, while another 92+ applications sit in front of the SEC. What was once a regulatory dead-end has quickly shifted into what looks like the start of a full-blown “ETF cycle” for digital assets.

Since the first spot Bitcoin ETFs launched in early 2024, the sector has seen explosive traction. Year-to-date inflows sit at $29.4B, with BlackRock’s iShares Bitcoin Trust (IBIT) out in front, up 28.1% in 2025 alone. This expansion has been powered by both a more favorable political climate and rising institutional demand.